Life insurance benefits are provided to a policys beneficiaries when the policyholder dies. Whole life doesnt have predefined terms and protects the insured for hisher whole life.

Once you file the claim and provide a copy of their death certificate the insurance company will process it.

How much does life insurance payout. This is the amount your beneficiary would receive if you were to die within the time frame of the policy. When you purchase life insurance you purchase a policy at a specific coverage amount. How does a payout work.

Recipients usually need to file a death claim with the insurance company by submitting a copy of the death certificate. The life insurance payout is the usually the same as the face amount. The beneficiary will then file a claim with the life insurance company to receive their payout when the insured dies heres how that works.

Some policies like guaranteed issue life insurance policies that dont require a medical exam or any medical information have low coverage amounts. How do life insurance payouts work. You determine how much your life insurance will pay out when you buy the policy.

A life insurance policy payout cant bring back a loved one. Learn how to file for a life insurance payout how long it takes to receive it and new ways to plan for payments that provide an income stream. Life insurance policies name a designated beneficiary or beneficiaries to receive a payout or death benefit in the case of the policyholders death.

If youre the beneficiary of a life insurance policy you will need to file a claim with the insurance provider when the policyholder dies to receive the payout youre entitled to. And take the time to discuss with them how much they will receive. How much does life insurance payout if you are looking for an easy way to get insurance quotes then our service provides you with a convenient way to get the information you need.

At that time you will choose the death benefit also called face amount. If the holder doesnt die heshe cant receive a portion of the premiums. If you have life insurance coverage make sure you let your beneficiaries know that they will be protected financially when you pass away.

Some exceptions would be if the cash value has grown beyond the face amount increasing the face amount or if money has been borrowed from the policy and not repaid reducing the face amount or if the policy was purchased with a decreasing face amount. Insurance companies then review the claim and issue the payout. Term life also known as pure life insurance term life lets the beneficiary claim the life insurance payout within a defined term from one to 30 years.

How Much Do You Know About Life Insurance Visual Ly

How Much Do You Know About Life Insurance Visual Ly

4 Tips To Sell Your Life Insurance Policy Visual Ly

4 Tips To Sell Your Life Insurance Policy Visual Ly

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

The Best Type Of Life Insurance For You Right Now

The Best Type Of Life Insurance For You Right Now

Calameo Needing Life Insurance For Parents

Calameo Needing Life Insurance For Parents

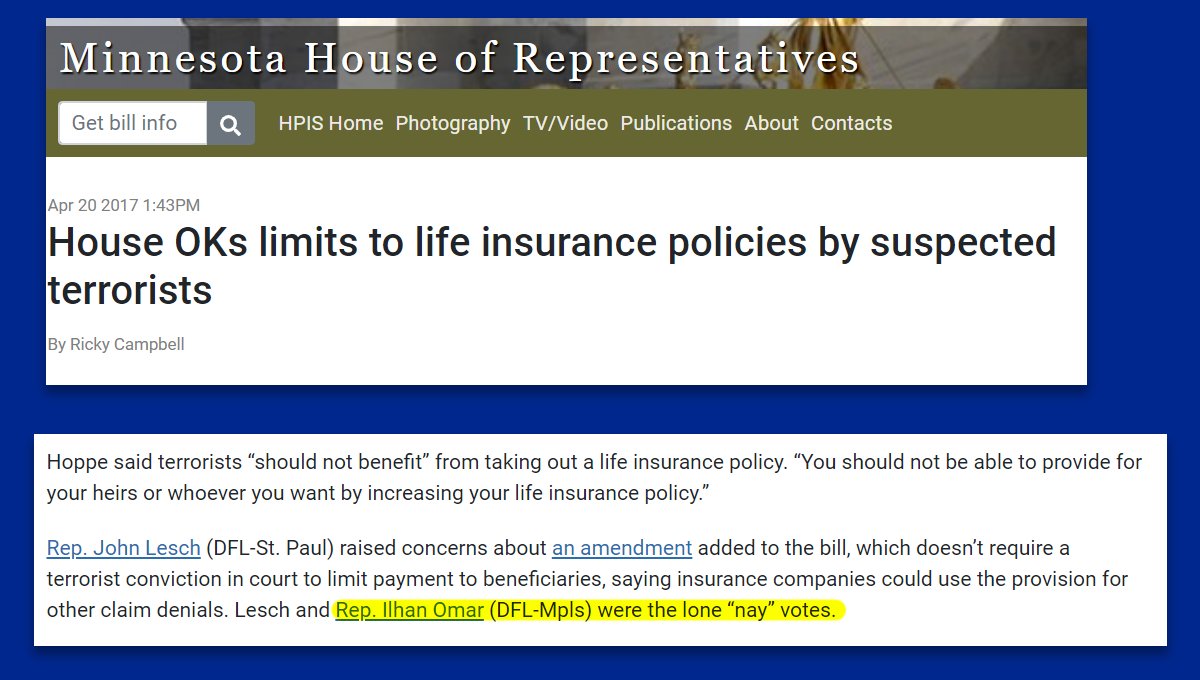

The Mossad Elite Parody Division On Twitter Antisemitism Aside

The Mossad Elite Parody Division On Twitter Antisemitism Aside

Could Your Ex Wife Get Your Insurance Payout Confused Com

Could Your Ex Wife Get Your Insurance Payout Confused Com

Beautiful Whole Of Life Insurance Quotes Uk Lifecoolquotes

Beautiful Whole Of Life Insurance Quotes Uk Lifecoolquotes

Best Life Insurance For Seniors For 2020 The Simple Dollar

Best Life Insurance For Seniors For 2020 The Simple Dollar

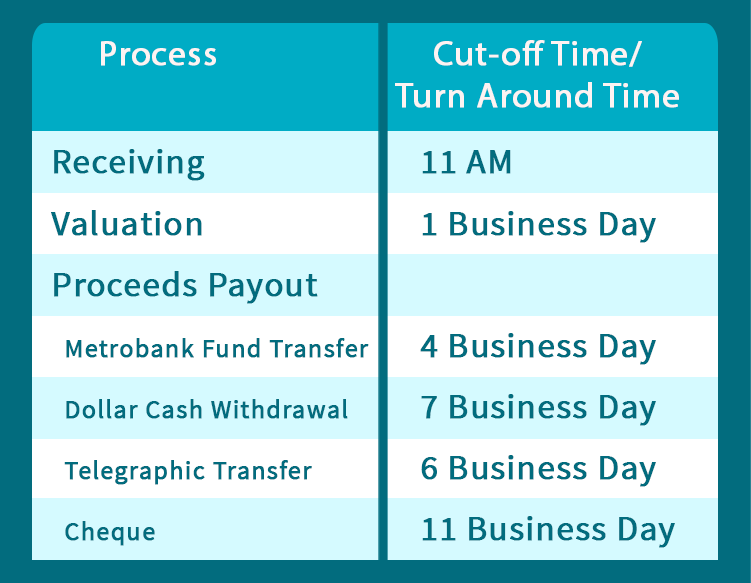

Frequently Asked Questions Axa Philippines

Frequently Asked Questions Axa Philippines

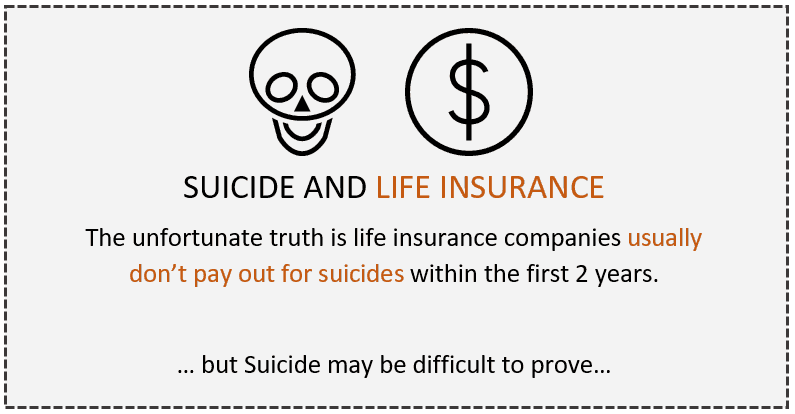

How To Avoid A Declined Payout During 2 Year Contestability Period

How To Avoid A Declined Payout During 2 Year Contestability Period

Educational Plan Achievers Allianz Pnb Life Insurance Inc

Educational Plan Achievers Allianz Pnb Life Insurance Inc

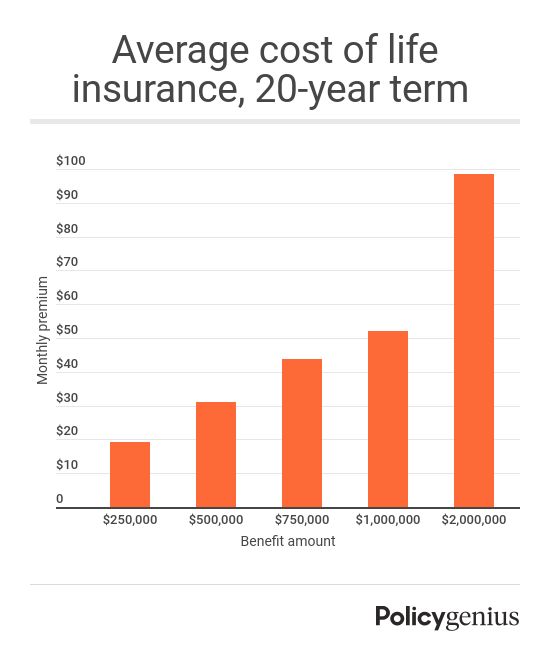

The Cost Of Life Insurance Policygenius

The Cost Of Life Insurance Policygenius

What Is Cash Value Life Insurance Daveramsey Com

What Is Cash Value Life Insurance Daveramsey Com

Colonial Penn Life Insurance Review 2020 Rates Fine Print

Colonial Penn Life Insurance Review 2020 Rates Fine Print

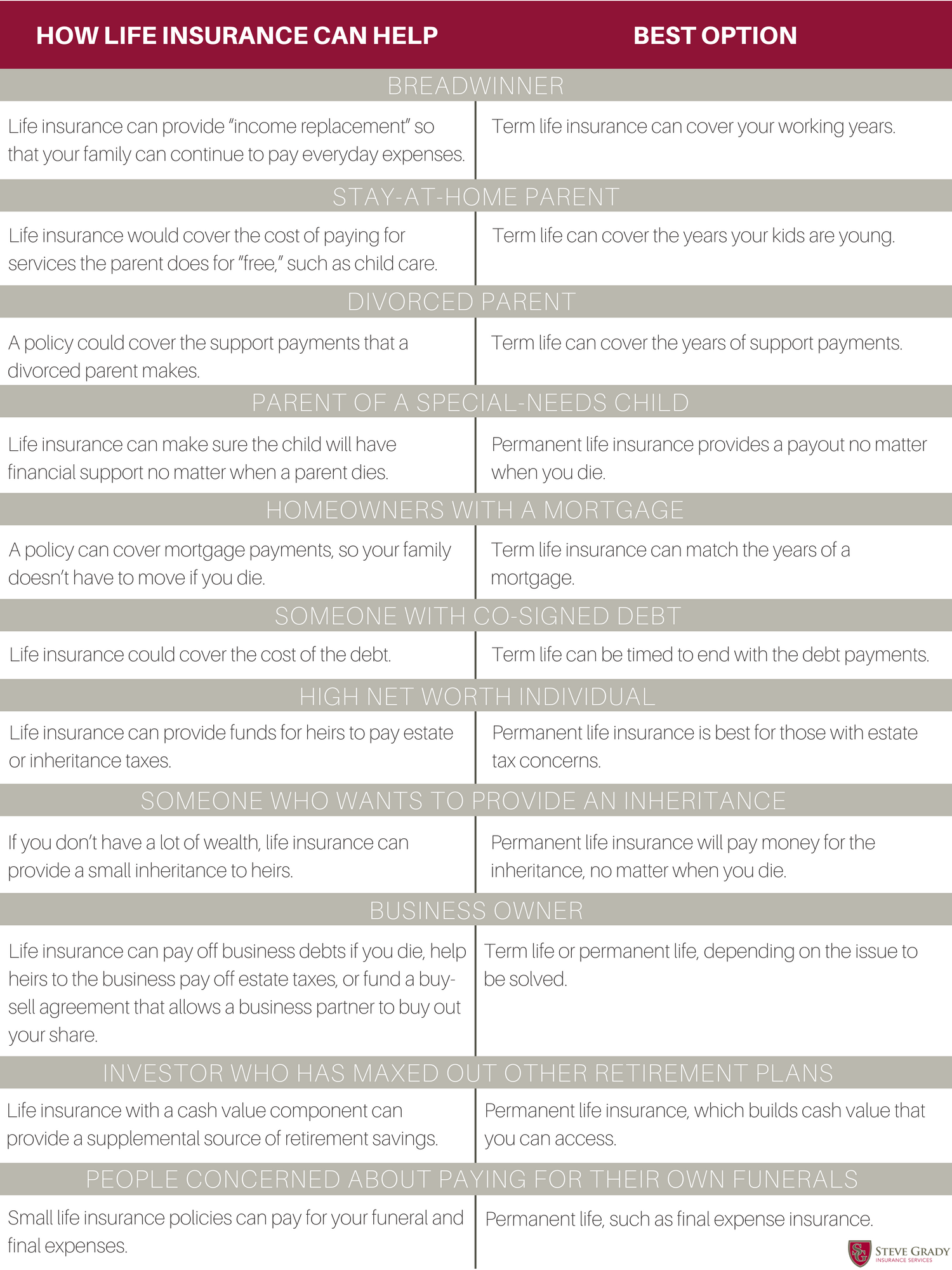

Life Insurance Steve Grady Insurance Services

Life Insurance Steve Grady Insurance Services

Term Life Insurance Definition

Term Life Insurance Definition

The Best Life Insurance Companies In 2020 Policygenius

The Best Life Insurance Companies In 2020 Policygenius

What To Do If You Don T Receive A Life Insurance Payout Kbg

What To Do If You Don T Receive A Life Insurance Payout Kbg

Do I Have To Pay Taxes On A Life Insurance Payout Family

Do I Have To Pay Taxes On A Life Insurance Payout Family

Chapter 12 Life Insurance Mcgraw Hill Irwin Ppt Download

Chapter 12 Life Insurance Mcgraw Hill Irwin Ppt Download

Comments

Post a Comment