Selling your life insurance policy safely. If you dont have a life threatening illness the higher your age the higher the offer you will receive for your life insurance policy.

3 Steps Guide To Sell My Life Insurance Policy Mintco Financial

3 Steps Guide To Sell My Life Insurance Policy Mintco Financial

Selling the policy means you wont have life insurance coverage and your beneficiaries will no longer receive the death benefit when you die but a quick cash influx can bring you a bit of comfort in old age.

How to sell a life insurance policy. It must be at least 100000 or more. Before you decide to sell a life insurance policy for cash carefully examine all of your options be aware of the pitfalls and make sure that it is a good decision for your specific circumstances. What does it mean to sell a life insurance policy.

Of course higher amounts are likely to fetch you a higher payout. The value of your life insurance policy impacts your offer as well. How to sell a life insurance policy if you are looking for the best insurance quotes then our free online service will give you the information you need in no time.

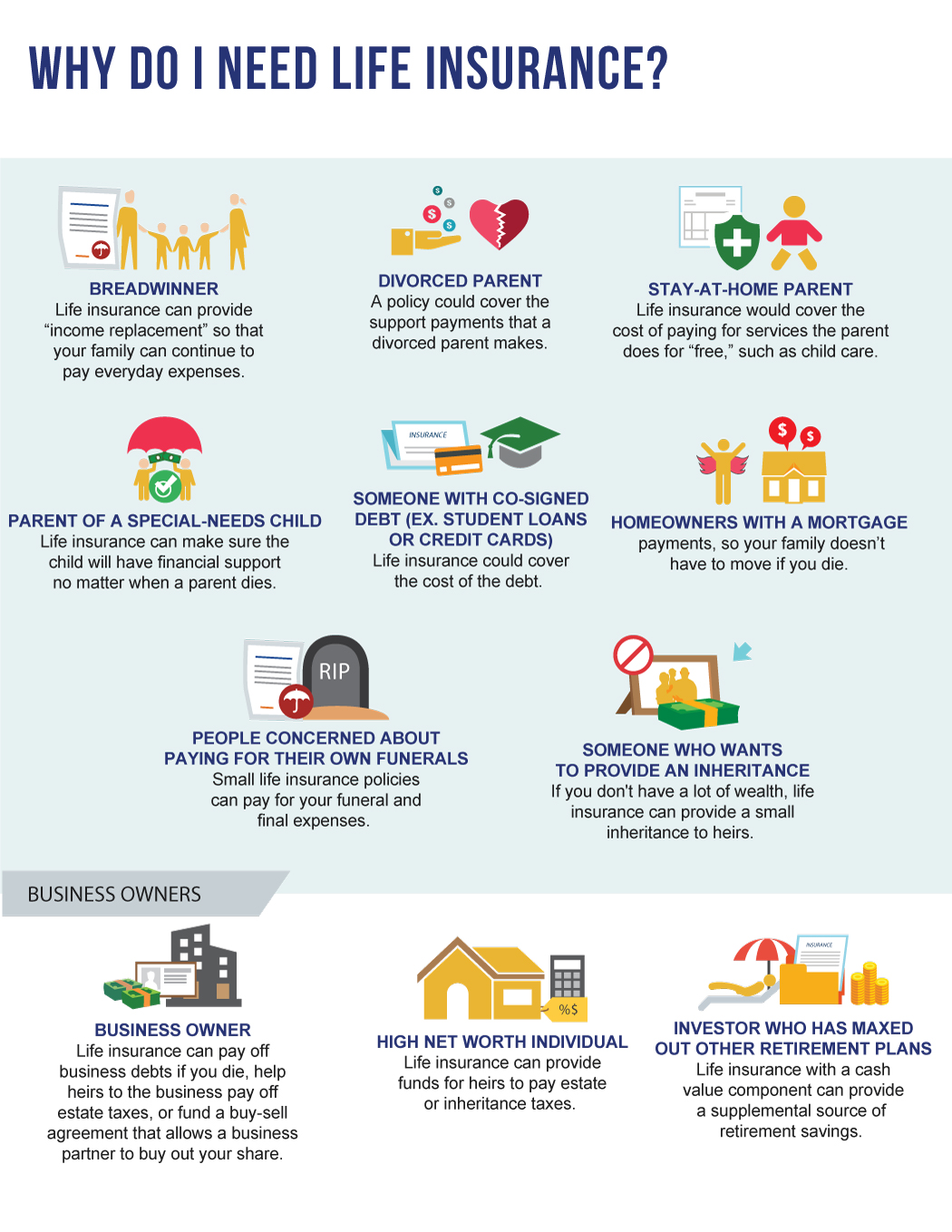

To sell your life insurance policy contact a licensed life settlement company. They will provide an offer based on your age health and policy. Most people purchase life insurance when they are looking for ways to protect their familys financial stability in the event of death.

How to sell a life insurance policy if you are looking for a convenient way to get quotes on different types of insurance then look no further than our insurance quotes service. Selling a life insurance policy is called a life settlement formerly known as and mostly synonymous with a viatical settlement. Can i sell my life insurance policy without a life settlement broker.

If you sell you will receive a cash payment that is larger than the cash surrender value but less than the death benefit. There may come a time when you wonder if it makes sense to continue to pay your life insurance premiums or if you want to cash in your life insurance policy. Follow these steps to make sure you get the best deal if you really want to sell your life insurance policy.

Selling a life insurance policy involves selling the policy to another entity or investor. Its possible to participate in a life settlement without the help of a broker. You should only attempt this if you have the stamina knowledge and patience to deal with a long process that involves a large and experienced investment firm.

Avoid responding to life settlement.

Funding A Buy Sell Agreement With Life Insurance True Blue Life

Funding A Buy Sell Agreement With Life Insurance True Blue Life

What To Know About Selling Your Life Insurance Policy

What To Know About Selling Your Life Insurance Policy

Can I Sell My Life Insurance Policy For Cash Senior Resources

Can I Sell My Life Insurance Policy For Cash Senior Resources

Efficient Ways To Sell Your Life Insurance Policy For Cash Pinoy

Efficient Ways To Sell Your Life Insurance Policy For Cash Pinoy

How To Sell Your Life Insurance Policy Money Talks News

How To Sell Your Life Insurance Policy Money Talks News

Retained Life Benefits Sell A Portion Of Your Policy

Retained Life Benefits Sell A Portion Of Your Policy

Selling Your Life Insurance Policy For Immediate Cash

Selling Your Life Insurance Policy For Immediate Cash

Ownership Structures For Life Insurance Policy Funded Buy Sell

Ownership Structures For Life Insurance Policy Funded Buy Sell

Why Sell Download Decision Guide

Why Sell Download Decision Guide

Can I Sell My Life Insurance Policy Selling Your Insurance Policy

Can I Sell My Life Insurance Policy Selling Your Insurance Policy

Is Selling Life Insurance A Good Career Coverdrive

Is Selling Life Insurance A Good Career Coverdrive

Do You Really Need Life Insurance Dynamic Planning Partners

Do You Really Need Life Insurance Dynamic Planning Partners

Top 5 Ways To Broach The Life Insurance Conversation

Top 5 Ways To Broach The Life Insurance Conversation

Do You Really Need Life Insurance Legacy Wealth Advisors

Do You Really Need Life Insurance Legacy Wealth Advisors

How Do You Qualify To Sell Your Life Insurance Policy

How Do You Qualify To Sell Your Life Insurance Policy

How To Sell Your Life Insurance Policy Get More Cash Insurance

How To Sell Your Life Insurance Policy Get More Cash Insurance

![]() Why 2020 Is The Year To Sell Your Life Insurance Policy For Cash

Why 2020 Is The Year To Sell Your Life Insurance Policy For Cash

Sell Your Life Insurance Policy Consumerism Commentary

Sell Your Life Insurance Policy Consumerism Commentary

Life Insurance Proceeds In Valuation For Buy Sell Agreements

Life Insurance Proceeds In Valuation For Buy Sell Agreements

Sell Life Insurance Policy By Prem Cholewa On Dribbble

Sell Life Insurance Policy By Prem Cholewa On Dribbble

Survivorship Life Insurance Definition Advantages Disadvantages

Survivorship Life Insurance Definition Advantages Disadvantages

Designcontest Sell My Life Insurance Policy Sell My Life Insurance

Designcontest Sell My Life Insurance Policy Sell My Life Insurance

How To Sell Life Insurance Amazing Youtube

How To Sell Life Insurance Amazing Youtube

Investment Wise Does It Make Sense To Sell Your Life Insurance

Investment Wise Does It Make Sense To Sell Your Life Insurance

Comments

Post a Comment