Specifically for those who cant be approved for a standard policy. Graded death benefit life insurance policies are a godsend for some people.

Graded Death Benefit Term Graded Death Benefit Whole Life From

Graded Death Benefit Term Graded Death Benefit Whole Life From

At that point an insurance company may offer a graded benefit whole life insurance policy.

Graded life insurance. Graded benefit whole life. What is graded benefit whole life insurance. It is a permanent life insurance policy as opposed to a term policy that ends after a pre designated period.

Insurance companies take great steps to. A life insurance policy is a contractual agreement with an insurance company to pay your heirs a sum of money if you die while the policy is active. The policy usually pays out limited death benefits during.

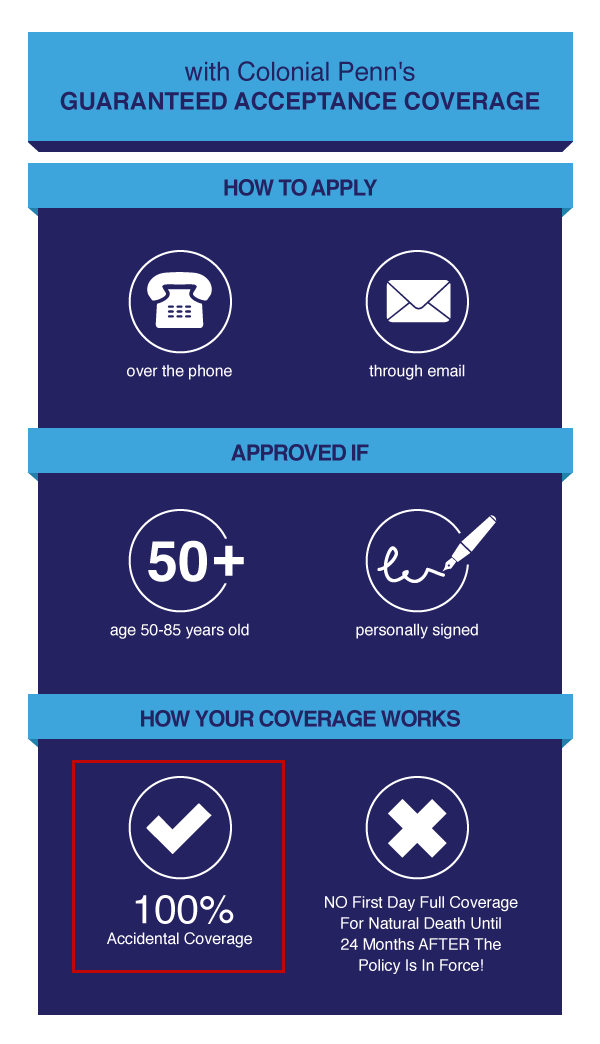

Graded benefit whole life insurance also known as gbl insurance is a specialty type of whole life insurance that is usually offered as life insurance policy for people that might have a hard time getting other types of life insurance. You can be declined from life insurance from all other companies and still get life insurance through a graded death benefit plan. Learn your options getting life insurance when you are uninsurable one of the biggest financial mistakes people make when they are young and holding down a good job is to rely on the life insurance provided by the employer.

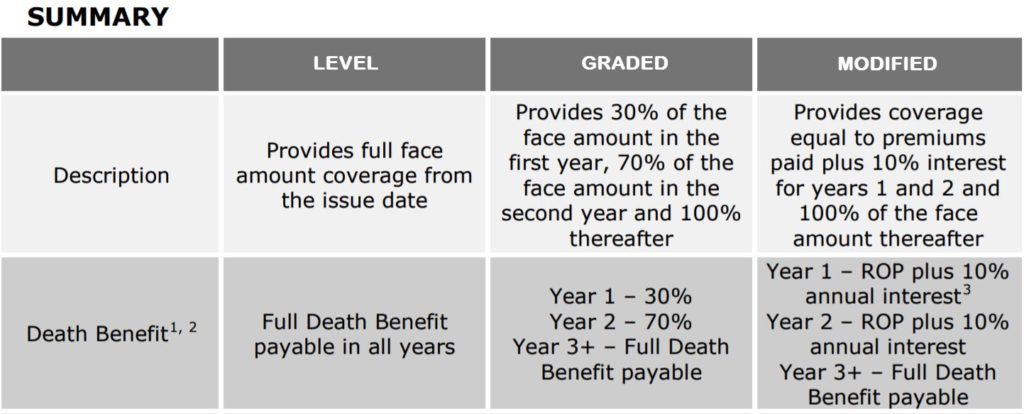

Graded benefit life insurance. What makes this type of life insurance different from standard permanent policies is that it is graded over time so that your premiums will not increase. Sometimes called high risk life insurance policies guaranteed issue life insurance or graded life insurance are all types of life insurance that are designed for those that are considered high risk and can not get a traditional policy.

Though some might not be sick enough to be considered uninsurable they may be too sick for a standard policy. As the name implies a graded policy is graded. Not every applicant for life insurance is in perfect health.

A graded life insurance policy is a type of policy that is often misunderstood because there is a waiting period it is permanent whole life insurance that is typically for those who have been turned down for coverage before because of health reasons. Graded life insurance if you are looking for insurance quotes on different types of insurance then our online service will provide you with the information you need. So how do these policies work.

7 Warnings About Guaranteed Issue Life Insurance Infographic

7 Warnings About Guaranteed Issue Life Insurance Infographic

No Exam Whole Life Insurance Explained In Detail Instant Application

No Exam Whole Life Insurance Explained In Detail Instant Application

Is Graded Benefit Life Insurance Worth It For Cancer Patients

Is Graded Benefit Life Insurance Worth It For Cancer Patients

What Is A Graded Death Benefit Compare 15 Insurance Carriers

What Is A Graded Death Benefit Compare 15 Insurance Carriers

About Graded Benefit Life Insurance Coverage Health Insurance

About Graded Benefit Life Insurance Coverage Health Insurance

What Is Modified Whole Life Insurance Secrets Revealed Buy Life

What Is Modified Whole Life Insurance Secrets Revealed Buy Life

Graded Premium Whole Life Insurance Online Business Definitions

Graded Premium Whole Life Insurance Online Business Definitions

Graded Death Benefit Life Insurance Best Rates Approvals

Graded Death Benefit Life Insurance Best Rates Approvals

Life Insurance Policies With No Waiting Period Yes It S Possible

Life Insurance Policies With No Waiting Period Yes It S Possible

What Is Modified Whole Life Insurance Secrets Revealed Buy Life

What Is Modified Whole Life Insurance Secrets Revealed Buy Life

Guaranteed Issue Whole Life Insurance Insurance From Aig In The Us

Guaranteed Issue Whole Life Insurance Insurance From Aig In The Us

Assurity Life Insurance Company Review Is It Worth It

Assurity Life Insurance Company Review Is It Worth It

Life Insurance 101 Breakdown Of How It Works Life Insurance 101

Life Insurance 101 Breakdown Of How It Works Life Insurance 101

Aaa Guaranteed Issue Life Insurance Review Compare Rates

Aaa Guaranteed Issue Life Insurance Review Compare Rates

How To Shop For Life Insurance Graded Life Insurance Plan

How To Shop For Life Insurance Graded Life Insurance Plan

How To Shop For Life Insurance Graded Life Insurance Plan

How To Shop For Life Insurance Graded Life Insurance Plan

Guaranteed Issue Life Insurance Aig Direct

Solved Attention Due To A Bug In Google Chrome This Page

Solved Attention Due To A Bug In Google Chrome This Page

How To Shop For Life Insurance Graded Life Insurance Plan

How To Shop For Life Insurance Graded Life Insurance Plan

10 Things You Need To Know About Life Insurance Without An Exam

10 Things You Need To Know About Life Insurance Without An Exam

Fillable Online Graded Death Benefit Term And Whole Life Insurance

Fillable Online Graded Death Benefit Term And Whole Life Insurance

Graded Death Benefit Life Insurance Best Rates Approvals

Graded Death Benefit Life Insurance Best Rates Approvals

Top 10 Final Expense Burial Insurance Companies 2020 Update

Top 10 Final Expense Burial Insurance Companies 2020 Update

Understanding Graded Benefit And Contestablity Periods True Blue

Understanding Graded Benefit And Contestablity Periods True Blue

Comments

Post a Comment