Also group life cover is usually written into trust which means the payout falls outside of the deceaseds estate for inheritance tax purposes. If the terms of the employment compel the employer to pay the premiums these must be taxed in the hands of the employee as a fringe benefit.

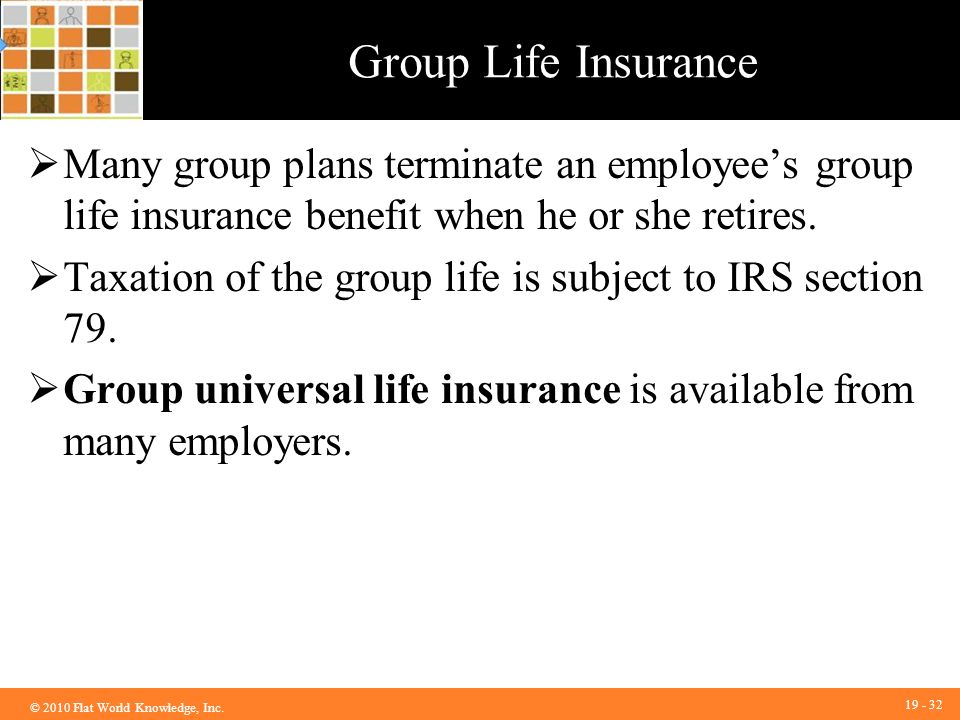

Mortality Risk Management Individual Life Insurance Ppt Video

Mortality Risk Management Individual Life Insurance Ppt Video

If you decide to offer it you need to be familiar with group term life insurance tax.

Group life insurance taxable benefit. If the terms of the employment compel the employee to pay the premiums. For employees the good news is that generally group life insurance is not a taxable benefit in kind p11d benefit which means there is no income tax to pay on the cover provided. This section applies to current former and retired employees.

And premiums to unapproved group life insurance is the same namely. The cost of employer provided group term life insurance on the life of an employees spouse or dependent paid by the employer is not taxable to the employee if the face amount of the coverage does not exceed 2000. In quebec premiums for health and dental insurance are also considered a taxable benefit.

This coverage is excluded as a de minimis fringe benefit. Group term life insurance is a benefit frequently offered by employers for their employees. Fifty five percent of private industry employees have access to employer sponsored life insurance and 98 of those employees enroll in the benefit.

As a popular benefit you might offer group term life insurance. Employer paid premiums for group life insurance dependant life insurance accident insurance and critical illness insurance are taxable benefits and the amounts paid on your behalf will be added to your taxable income. Premiums you pay for employees group life insurance that is not group term insurance or optional dependent life insurance are also a taxable benefit.

Group term life insurance policies employer paid premiums. Many employers provide at no cost a base amount of group coverage as well as the ability to purchase.

Ultimate Guide To Short Term Disability Benefits In Canada

Ultimate Guide To Short Term Disability Benefits In Canada

:brightness(10):contrast(5):no_upscale()/GettyImages-658436106-591e3b083df78cf5fad9a2a2.jpg) Employer Guide What Employee Compensation Is Taxable

Employer Guide What Employee Compensation Is Taxable

Group Life Insurance Group Life Insurance Non Cash Taxable Benefit

Group Life Insurance Group Life Insurance Non Cash Taxable Benefit

5 Lesser Known Facts About Tax Benefits Of Health Insurance The

5 Lesser Known Facts About Tax Benefits Of Health Insurance The

Solved Ebook Problem 4 38 Nontaxable Fringe Benefits Lo

Solved Ebook Problem 4 38 Nontaxable Fringe Benefits Lo

How To Cancel Your Life Insurance Policy Policygenius

How To Cancel Your Life Insurance Policy Policygenius

Group Term Life Insurance What You Need To Know

Group Term Life Insurance What You Need To Know

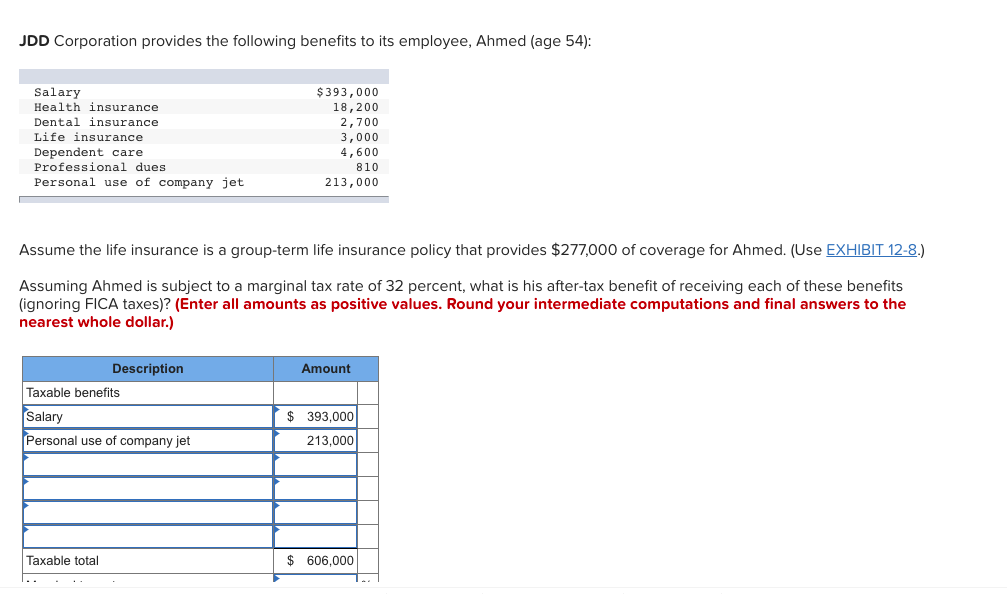

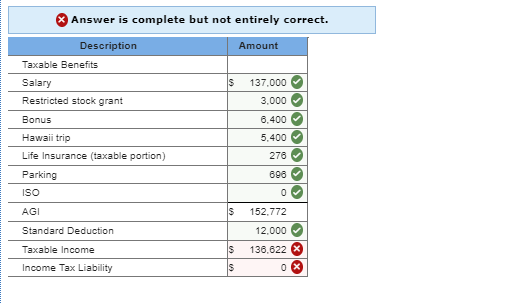

Solved Jdd Corporation Provides The Following Benefits To

Solved Jdd Corporation Provides The Following Benefits To

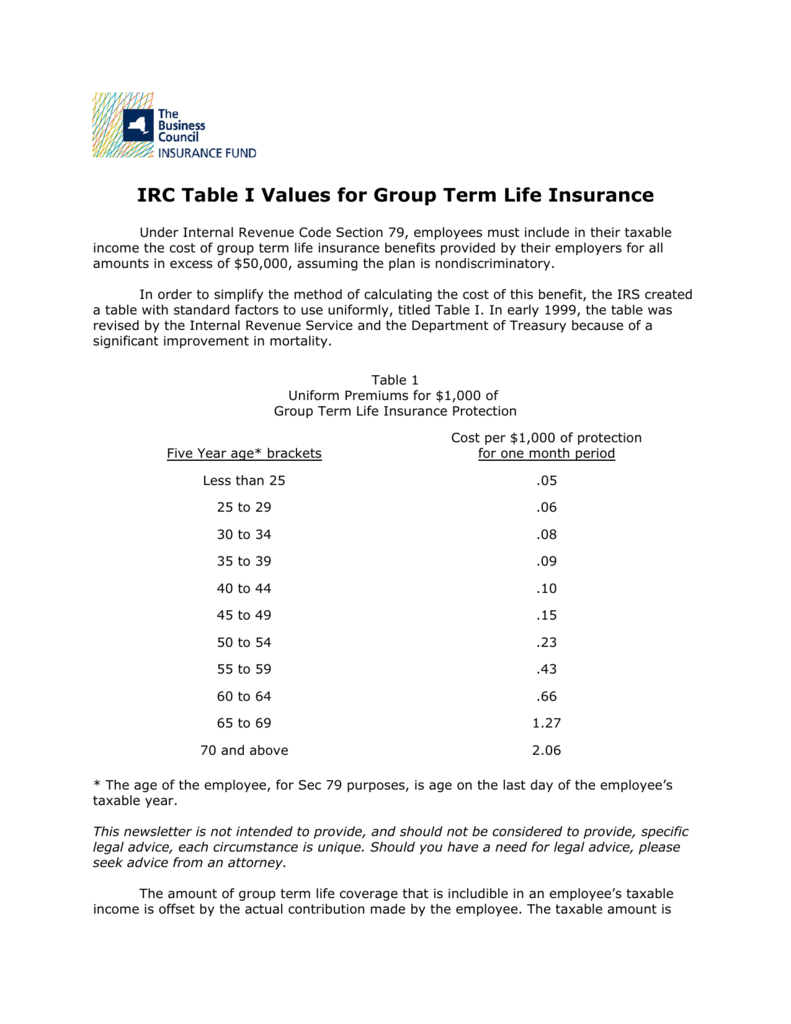

To Have Access To Irc Table I Values For Group Term Life Insurance

To Have Access To Irc Table I Values For Group Term Life Insurance

Surrender A Universal Life Insurance Policy Wealth Management

Surrender A Universal Life Insurance Policy Wealth Management

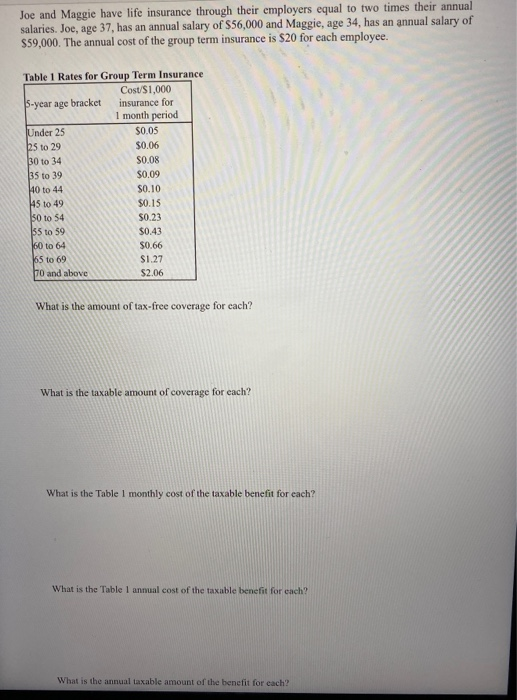

Joe And Maggie Have Life Insurance Through Their E Chegg Com

Joe And Maggie Have Life Insurance Through Their E Chegg Com

Ohio Life Final Exam Advantage Education Group Take Pages

Ohio Life Final Exam Advantage Education Group Take Pages

Solved Santinl S New Contract For 2018 Indicates The Foll

Solved Santinl S New Contract For 2018 Indicates The Foll

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Group Life Insurance Group Life Insurance Non Cash Taxable Benefit

Group Life Insurance Group Life Insurance Non Cash Taxable Benefit

Group Life Insurance Premiums Taxable In Manitoba Benefits Canada

Group Life Insurance Premiums Taxable In Manitoba Benefits Canada

What Is A Section 125 Pop Premium Only Plan Gusto

What Is A Section 125 Pop Premium Only Plan Gusto

Are Life Insurance Premiums Tax Deductible Fwd Philippines

Are Life Insurance Premiums Tax Deductible Fwd Philippines

/GettyImages-658436106-591e3b083df78cf5fad9a2a2.jpg) Employer Guide What Employee Compensation Is Taxable

Employer Guide What Employee Compensation Is Taxable

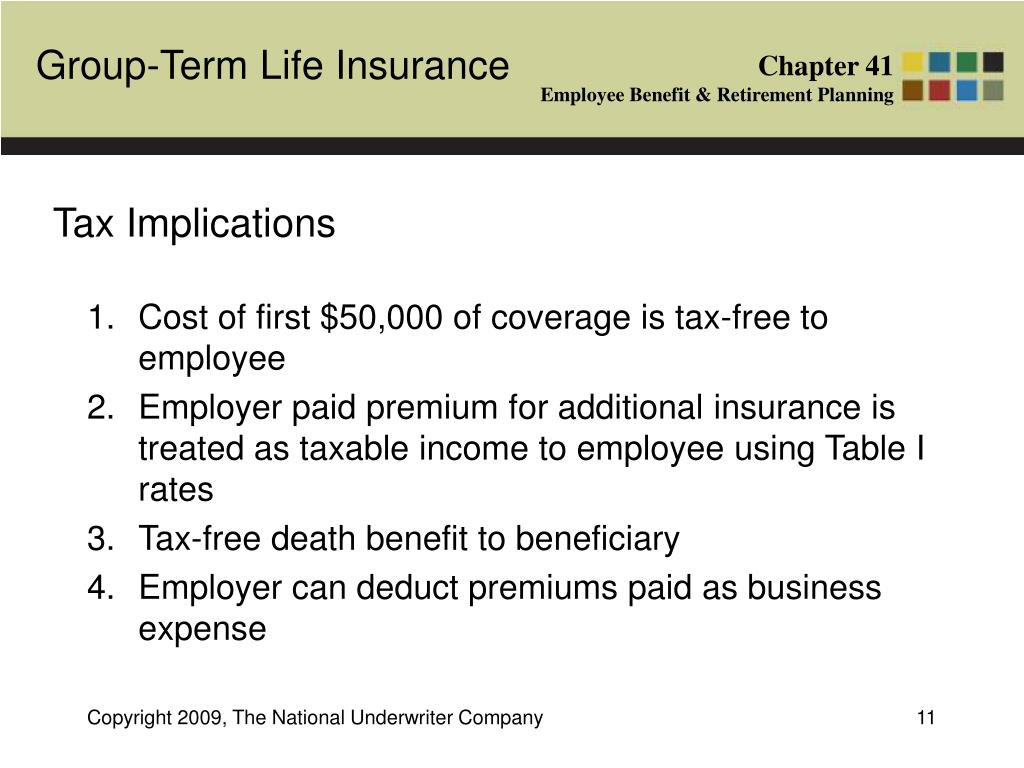

Ppt What Is It Powerpoint Presentation Free Download Id 3224370

Ppt What Is It Powerpoint Presentation Free Download Id 3224370

Overview Calculating The Cost Of Group Term Life Insurance

Overview Calculating The Cost Of Group Term Life Insurance

How Are Employees Taxed If They Pay For Group Term Life Insurance

How Are Employees Taxed If They Pay For Group Term Life Insurance

Comments

Post a Comment