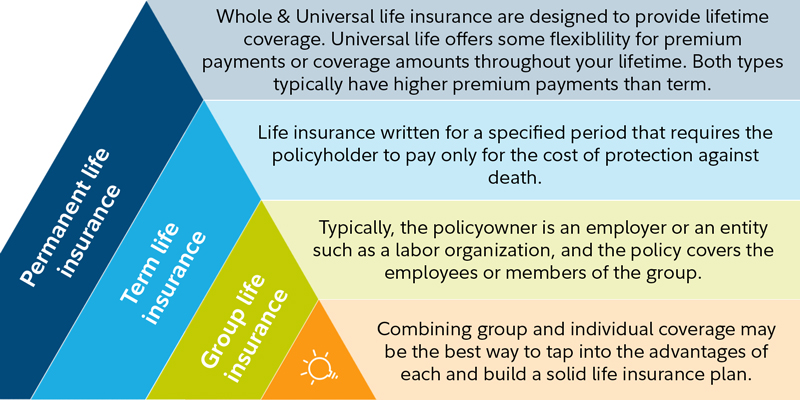

Group term life insurance is a benefit frequently offered by employers for their employees. Many employers offering employee benefits consider group term life insurance an essential part of their benefits package.

Term Life Insurance At Work Voya Financial

Term Life Insurance At Work Voya Financial

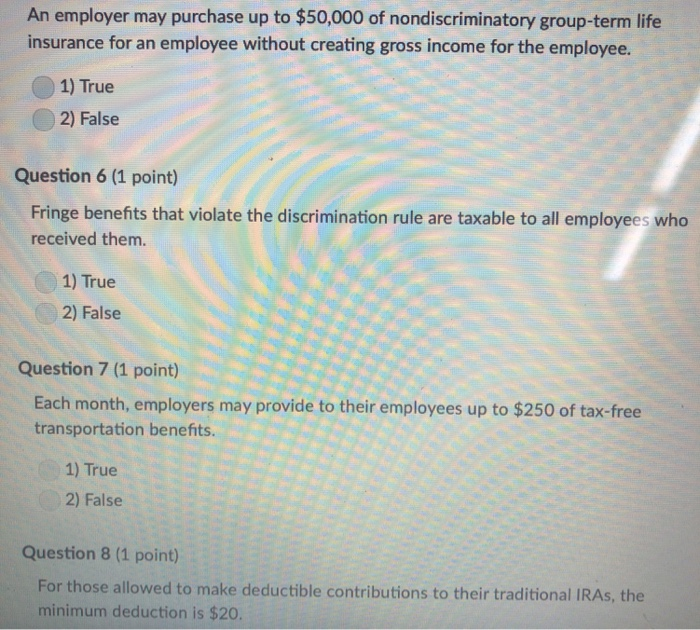

Total amount of coverage irc section 79 provides an exclusion for the first 50000 of group term life insurance coverage provided under a policy carried directly or indirectly by an employer.

Group term life insurance iras. Many employers provide at no cost a base amount of group coverage as well as the ability to purchase. Find out if group term life insurance coverage provided for employees is taxable. According to internal revenue service section 79 if an employee receives more than 50000 of group term life insurance under a policy carried by his employer the imputed cost of coverage over 50000 is considered taxable income and is subject to social security and medicare taxes.

Group life insurance shows employees you value what matters most to themtheir loved ones. In the past we have produced a late year silverlink special bulletin regarding the potential tax consequences of employer sponsored group term life insurance plans. This amount is subject to social security and medicare taxes but not futa tax or income tax withholding.

Employer has taken up a group term life insurance policy for the employees who are not the named beneficiary. Premiums paid for insurance policy bought on your childs life are not allowed. Group term life insurance policy where employees are the intended beneficiaries either because the employees are the named beneficiaries or there is a contractual obligation for the employer to pass the payout to the employees or their next of kin.

Group life insurance policies are generally written as term insurance offered as a group benefit to employees who meet eligibility requirements such as being a permanent employee or 30 days after. The amount of relief you may claim must not be more than 7 of the insured value of your life or your wifes life. The premiums are not taxable if the employer policyholder has a choice or the discretion to decide whether he wants to disburse the insurance payout from the group insurance policy to the employee or his next of kin.

Below are examples of insurance premiums that are deductible. It provides employees with a basic level of protection. You can claim the insurance premiums that you have paid for life insurance policies bought on your life or your wifes life.

Group term life insurance irs regulations include in wages the cost of group term life insurance you provided to an employee for more than 50000 of coverage or for coverage that discriminated in favor of the employee. For the most part these rules have generally remained unchanged for the past decade.

:max_bytes(150000):strip_icc()/GettyImages-1146031987-6240be09e5344ea1a5414fa09008fab1.jpg) Understanding Indexed Universal Life Insurance Vs Iras 401 K S

Understanding Indexed Universal Life Insurance Vs Iras 401 K S

Secure Act Signed By President A Game Changer For Retirement Plans

Secure Act Signed By President A Game Changer For Retirement Plans

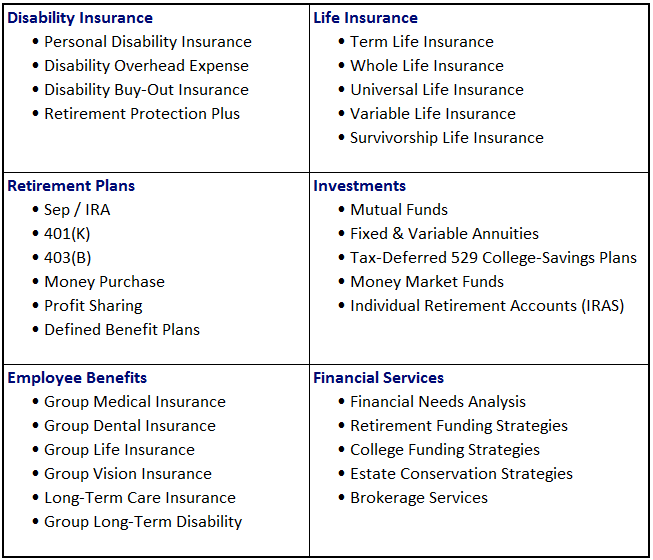

Our Services Axiom Financial Services Llc

Our Services Axiom Financial Services Llc

Helping You Hbl Group Llc Navigate Life S Insurance Financial

Helping You Hbl Group Llc Navigate Life S Insurance Financial

Hsas Could Trump Iras For Retirement Investing 101 Us News

Hsas Could Trump Iras For Retirement Investing 101 Us News

Credit Union Personal Insurance Rbfcu

Visit Our Website At Ppt Download

Visit Our Website At Ppt Download

Solved An Employer May Purchase Up To 50 000 Of Nondiscr

Solved An Employer May Purchase Up To 50 000 Of Nondiscr

Save Like A Superhero Roth Iras And 529 Plans Nerdwallet

Save Like A Superhero Roth Iras And 529 Plans Nerdwallet

Self Directed Iras A Tax Compliance Black Hole

Self Directed Iras A Tax Compliance Black Hole

Layering Life Insurance Policies Fidelity Investments

Layering Life Insurance Policies Fidelity Investments

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja

Chapter 12 Employee Benefits Ppt Video Online Download

Chapter 12 Employee Benefits Ppt Video Online Download

Employee Benefits Introduction Legally Required Benefits Voulntary

Employee Benefits Introduction Legally Required Benefits Voulntary

Introduction To Life Insurance And Retirement Savings Alison

Introduction To Life Insurance And Retirement Savings Alison

Using Life Insurance Retirement Plans Lirps As A Tax

Using Life Insurance Retirement Plans Lirps As A Tax

We Offer Index Universal Life Insurance From Monumental Life In

We Offer Index Universal Life Insurance From Monumental Life In

Understanding Inherited Ira Rules Aarp

Understanding Inherited Ira Rules Aarp

Investing For Retirement Just Got Easier Life Insurance 401k Iras

Investing For Retirement Just Got Easier Life Insurance 401k Iras

Roth Ira Now S The Time To Convert Your Traditional Ira Money

Roth Ira Now S The Time To Convert Your Traditional Ira Money

Comments

Post a Comment