We know that once per year the mutuals and other companies that issue participating whole life insurance release press releases to announce the dividend payout for the following year. Often the overall growth of the whole life insurance policys cash value can actually be boosted with this strategy.

Everything You Need To Know About 10 Year Term Life Insurance

Everything You Need To Know About 10 Year Term Life Insurance

Whole life insurance dividends have long mystified both consumers and agents.

How do whole life insurance policies work. What are the advantages of this approach over other policies. Whole life insurance is designed to provide coverage for the life of the insured. We can help you find a plan that will fit your budget.

If an owner desires a conservative position for his cash values par whole life is indicated. But when life insurance is handled correctly it isnt gambling at all. Whole of life insurance is designed so the policy pays out a lump sum to your loved ones when you die.

Whole life insurance is a type of permanent life insurance that offers cash value. To learn more and to discover what an insurance strategy based on a properly designed whole life insurance policy can do for you request your free no obligation analysis today. However universal life policies run a much greater risk and are actually designed to lapse.

Whole life typically costs 3 to 5 times as much as term insurance for the same dollar amount of coverage according to money crashershowever many traditional whole life policies charge level premiums which are guaranteed never to changeif you have term insurance on the other hand you may be able to renew it after the term but the premiums typically increase because youre older. Its simply part of a larger economic plan whose goal is the financial security of your family. So what is the best type of life insurance to buy and how much coverage do you need.

These policies allow you to build up cash that you can tap into while youre alive. How do whole life insurance policies work if you are looking for multiple quotes on different types of insurance then our insurance quotes service can give you the information you need. So in that way it can be seen as a kind of investment as well as a way to provide for loved ones after the die.

If you dont have any kids do you even need life insurance. Whole life policies generally offer fixed premiums guaranteed death benefits and are designed to build tax. You pay in a premium every month and when you die the policy pays out a.

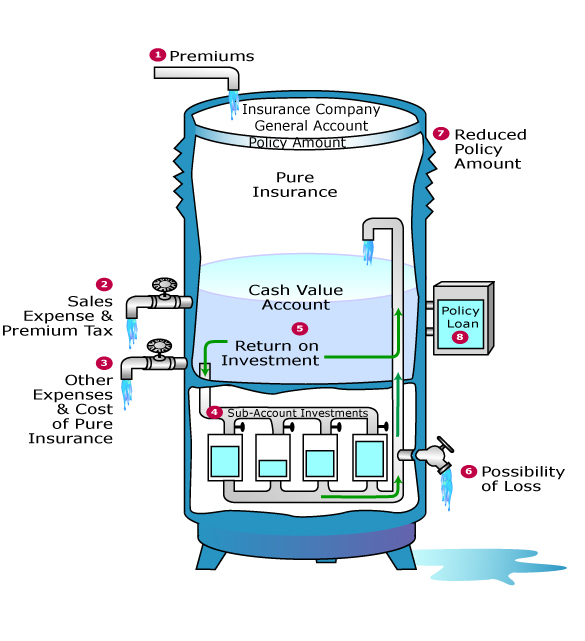

How do whole life insurance policies work if you are looking for the best prices on insurance then youve come to the right place. Whole of life insurance is designed to last as long as you do. Variable universal life insurance may outperform whole life because the owner can direct investments in sub accounts that may do better.

Shawn Parker Dubai How Does A Whole Life Insurance Policy Work

Shawn Parker Dubai How Does A Whole Life Insurance Policy Work

Term Life Insurance Vs Whole And Universal Life Insurance Policies

Term Life Insurance Vs Whole And Universal Life Insurance Policies

Letters Of Explanation Whole Life Term Blend Bill Boersma On

Letters Of Explanation Whole Life Term Blend Bill Boersma On

Life Insurance Check Out Best Insurance Polices 09 Feb 2020

Life Insurance Check Out Best Insurance Polices 09 Feb 2020

Search Q Universal Life Insurance Tbm Isch

Whole Life Insurance Argument Insurers Steals Your Cash Value

Whole Life Insurance Argument Insurers Steals Your Cash Value

Beneficiary Cash Value Life Insurance Policy Endowment Policy Face

Beneficiary Cash Value Life Insurance Policy Endowment Policy Face

Best Life Insurance For Children Quotes Apply 100 Online

Best Life Insurance For Children Quotes Apply 100 Online

Life Insurance In Singapore The Basics Of Whole Life And Term

Life Insurance Policies How Do Whole Life Insurance Policies Work

Life Insurance Policies How Do Whole Life Insurance Policies Work

Http Uknight Org Photos The 20advantages 20of 20whole 20life 20insurance 2 Pdf

Find The Best Whole Life Insurance

Find The Best Whole Life Insurance

Whole Life Insurance What You Need To Know

Whole Life Insurance What You Need To Know

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg) Whole Life Insurance Definition

Whole Life Insurance Definition

Some Points You Need To Know About Whole Life Insurance By

Some Points You Need To Know About Whole Life Insurance By

Universal Life Insurance Definition

Universal Life Insurance Definition

Variable Universal Life Insurance Vul Success Financial Freedom

Variable Universal Life Insurance Vul Success Financial Freedom

What Will Be The Free Look Period In Life Insurance Policies And Why

What Will Be The Free Look Period In Life Insurance Policies And Why

Term Life Insurance Definition

Term Life Insurance Definition

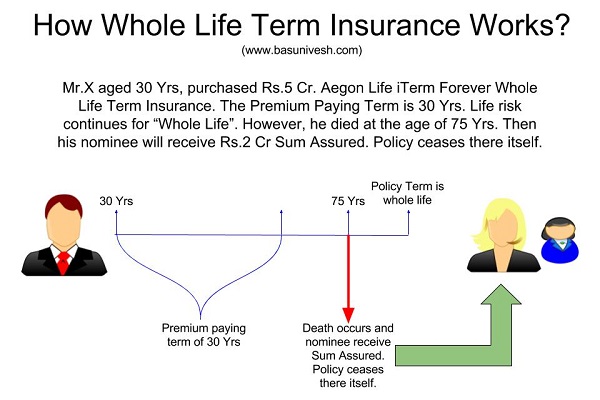

Aegon Life Iterm Forever Whole Life Term Insurance Should You

Aegon Life Iterm Forever Whole Life Term Insurance Should You

Term Life Insurance Definition

Term Life Insurance Definition

Comments

Post a Comment