Why should i buy life insurance. Learn more about how life insurance works.

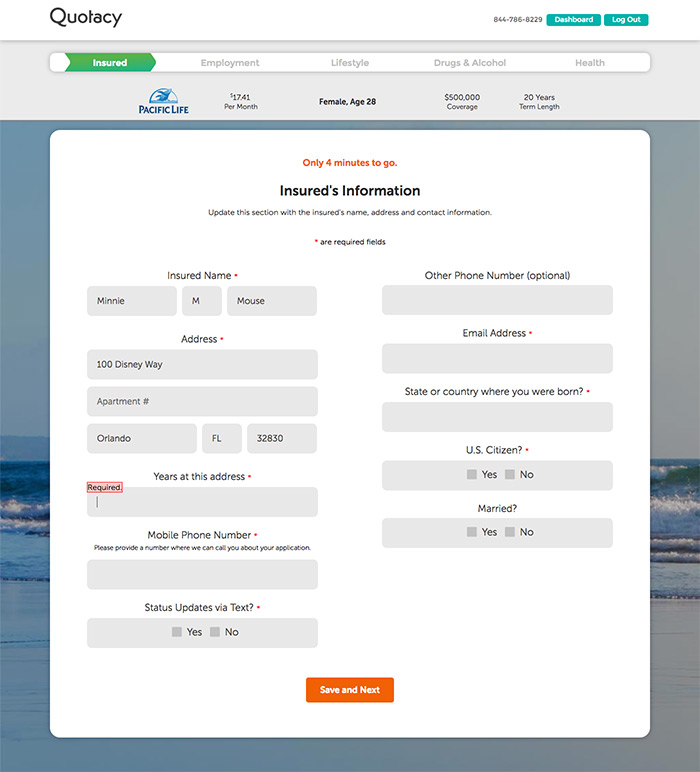

Can I Buy Life Insurance On Someone Else Quotacy

Can I Buy Life Insurance On Someone Else Quotacy

Most life insurance companies will also require you to file a benefits claim with them before they will release the money.

How life insurance companies work. How payouts work. The policyholder pays a recurring amount of money the premium to an insurance company. Life insurance policies may be.

How does life insurance work. Life insurance is a contract between you and a life insurance company. Types of life insurance.

If the policyholder dies while the policy is active the insurer pays out a tax free sum of money the death benefit. Life insurance is pretty simple. A life insurance claim can be a complex set of documents that detail the manner and cause of death as well as other details that the insurance agency may need to know to pay the correct death benefit.

You agree to pay for the policy on a regular basis and the insurer agrees to pay a sum of. Insurance companies sell coverage designed to help protect you against loss theft or damage to you or your property. The life insurance company should be contacted as soon as possible following the death of the insured to begin the claims and payout process.

Life insurance companies mainly issue policies that pay a death benefit as a lump sum upon the death of the insured to their beneficiaries. The insurance companies make this possible by sharing risk among a large group of people. Life insurance provides money for your loved ones in the event you die and cannot take of them.

How insurance companies work join us for a primer on how the insurance industry works how insurers make money and how to evaluate insurance stocks for potential investment opportunities. Group life insurance also known as wholesale life insurance or institutional life insurance is term insurance covering a group of people usually employees of a company members of a union or association or members of a pension or superannuation fund. Life insurance should more properly be called death insurance because the event that matters is someones death.

A life insurance policy is essentially a contract between an insurance company insurer and another person owner or policyholder. How do insurance companies work. Individual proof of insurability is not normally a consideration in its underwriting.

How life insurance policies work.

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Frictionless Business And The Future Of Life Insurance Accenture

Frictionless Business And The Future Of Life Insurance Accenture

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

How Does A Life Insurance Policy Work Life Insurance Policy

How Does A Life Insurance Policy Work Life Insurance Policy

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

How Does An Insurance Company S Non Life Business Work

How Does An Insurance Company S Non Life Business Work

Life Insurance Insurance From Aig In The Us

Life Insurance Insurance From Aig In The Us

How Does A Health Plan Work For American Financial Security Life

How Does A Health Plan Work For American Financial Security Life

How Does Insurance Work Get Familiar With Insurance Work

How Does Insurance Work Get Familiar With Insurance Work

How A Life Insurance Payout Actually Works Mason Finance

How A Life Insurance Payout Actually Works Mason Finance

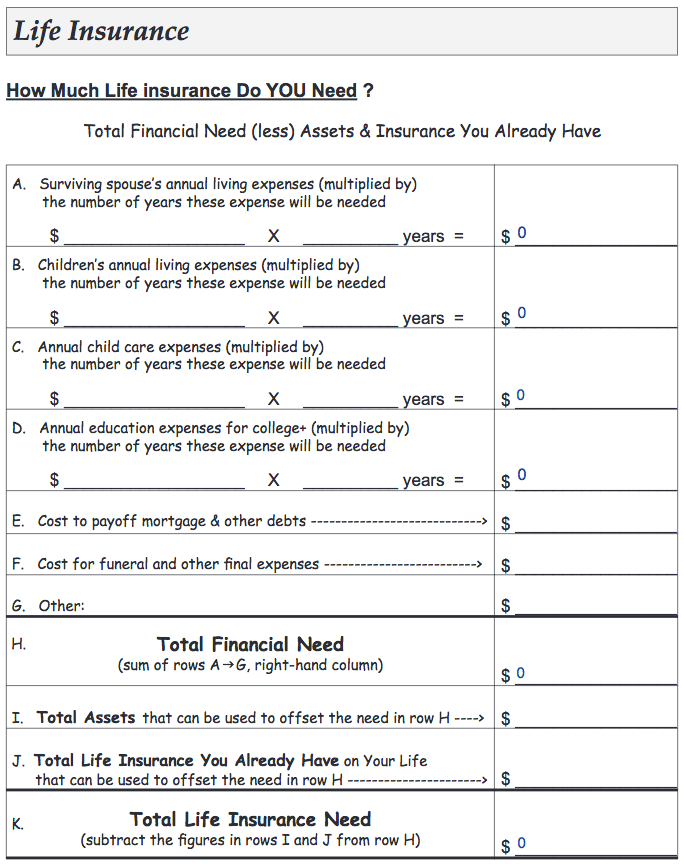

How Much Life Insurance Do You Need A Free Simple Worksheet

How Much Life Insurance Do You Need A Free Simple Worksheet

For Life Insurers Making Money Is A Numbers Game Life Insurance

For Life Insurers Making Money Is A Numbers Game Life Insurance

Colonial Penn Life Insurance Review 2020 Rates Fine Print

Colonial Penn Life Insurance Review 2020 Rates Fine Print

Types Of Life Insurance Policies In India

Types Of Life Insurance Policies In India

How Life Insurance Works Your Guide To Understanding Life Insurance

How Life Insurance Works Your Guide To Understanding Life Insurance

Life Insurance 101 The Basics Bright New Wearld

Life Insurance 101 The Basics Bright New Wearld

How A Life Insurance Payout Actually Works Mason Finance

How A Life Insurance Payout Actually Works Mason Finance

How Life Insurance Works And Why You Don T Have Enough Life

How Life Insurance Works And Why You Don T Have Enough Life

Life Insurance Companies We Work With The Best Companies In The Us

Life Insurance Companies We Work With The Best Companies In The Us

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

Comments

Post a Comment