When you make an insurance claim on your life policy it can often be at a time of increased stress. Unclaimed life insurance benefits total at least 1 billion according to consumer reports.

Annuity And Variable Life Insurance Death Benefits Claim Form

Annuity And Variable Life Insurance Death Benefits Claim Form

Filing a life insurance claim can take at least one worry off of your mind and youll ensure that the policyholder wasnt paying premiums all those years for nothing.

How to claim life insurance benefits. Heres how to make a life insurance claim. Losing someone is heart breaking but they may have a life insurance policy in place to give financial support to family or friends. When an applicant files for life insurance policy he or she nominates a beneficiary who can receive the death benefits in case of death of the policyholder.

Whether a death in the family is sudden or follows a long illness there are unexpected expenses and the challenge of trying to keep a family together after the loss of a breadwinner. You must file a claim by informing the insurer and submit the relevant documents following which the company will verify and pay you the benefits. If you dont you probably wont see the money and you definitely wont be alone.

Life insurance companies pay out more than 60 billion to americans each year but many policies go unclaimed. How to file a life insurance claim. The insurance company will send a check made out to the beneficiary unless arrangements are made for electronic funds transfer.

To ensure that you receive your benefits justly and as soon as possible it is essential that you understand every step of the claims process. Insurance companies usually process claims quickly when instructions are followed and a proper death certificate is provided. How to claim your life insurance how to claim your life insurance there are certain benefits that you are eligible to receive when you avail a policy.

Here is how to deal with their life insurance claim. How to claim tax benefits on life insurance how to claim tax benefits on life insurance how to claim tax benefits on life insurance there is a specific provision for life insurance premiums in section 80c of the income tax act which makes policyholders eligible for tax deductions on the amount paid as premium. The beneficiary has to follow a process to file the death benefit claims with the insurance company in order to receive the money.

The good news is that claiming a life insurance policy is pretty basic once you know what you need to do and thats exactly what were here to teach you. If you are the beneficiary on a recently deceased persons life insurance policy you need to file a claim for the death benefit.

Word Writing Text Life Insurance Business Concept For Payment Of

Word Writing Text Life Insurance Business Concept For Payment Of

Policies Issued By American General Life Insurance Company Agl

Policies Issued By American General Life Insurance Company Agl

Term Insurance Premium Options Pros And Cons Of Paying Regular

Term Insurance Premium Options Pros And Cons Of Paying Regular

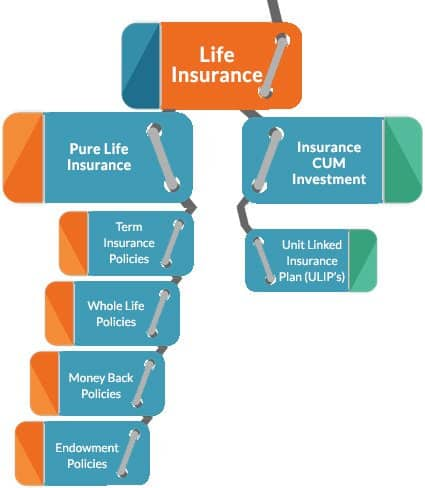

Life Insurance Online Life Insurance Plans Polices In India

Life Insurance Online Life Insurance Plans Polices In India

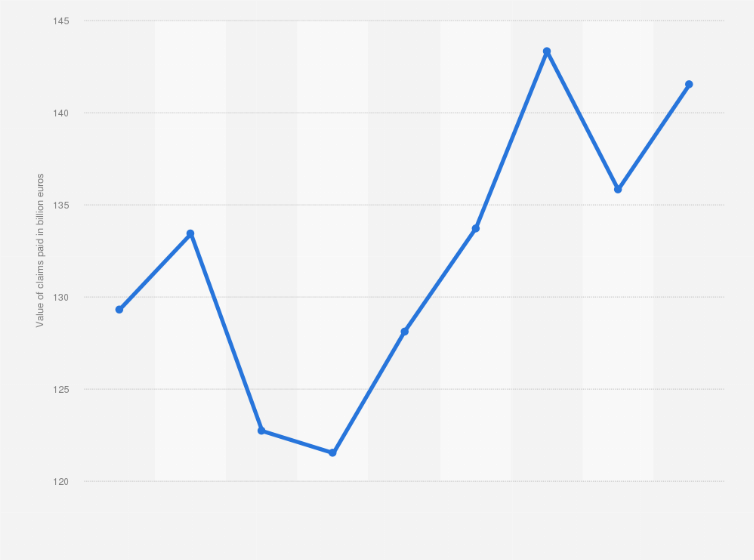

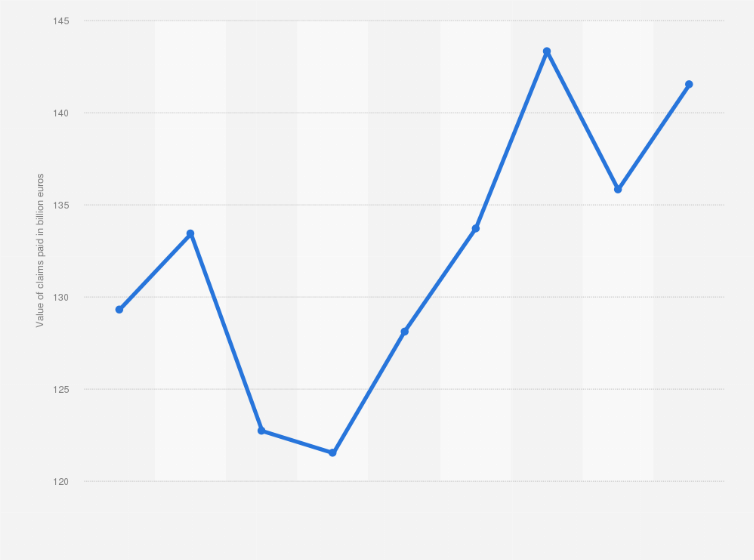

France Life Insurance Benefits Claims And Withdrawals 2016

France Life Insurance Benefits Claims And Withdrawals 2016

How Long Does It Take To Get Life Insurance Death Benefits

How Long Does It Take To Get Life Insurance Death Benefits

Search Q Insurance Policy Form Tbm Isch

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

10 Things You Absolutely Need To Know About Life Insurance

10 Things You Absolutely Need To Know About Life Insurance

How To Claim Life Insurance After Death Archives Empower Life

How To Claim Life Insurance After Death Archives Empower Life

Claim Settlement Ratio Of Life Insurance

Claim Settlement Ratio Of Life Insurance

John Hancock Life Insurance Death Benefit Claim Forms Form

John Hancock Life Insurance Death Benefit Claim Forms Form

Text Sign Showing Life Insurance Business Photo Showcasing

Text Sign Showing Life Insurance Business Photo Showcasing

Is Life Insurance A Smart Investment

Is Life Insurance A Smart Investment

Writing Note Showing Life Insurance Business Photo Showcasing

Writing Note Showing Life Insurance Business Photo Showcasing

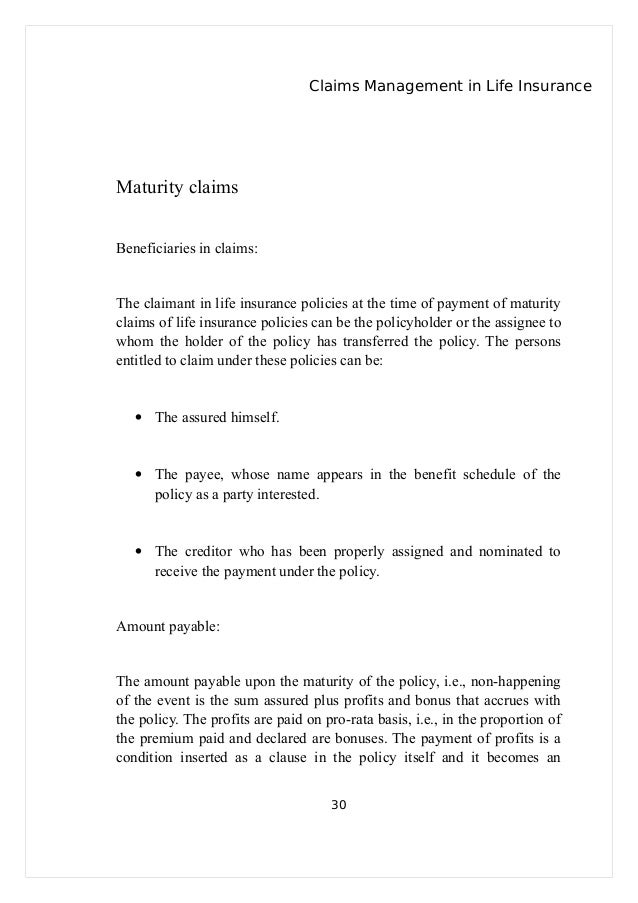

Project On Claims Management In Life Insurance

Project On Claims Management In Life Insurance

How To Claim Life Insurance Death Benefit Youtube

How To Claim Life Insurance Death Benefit Youtube

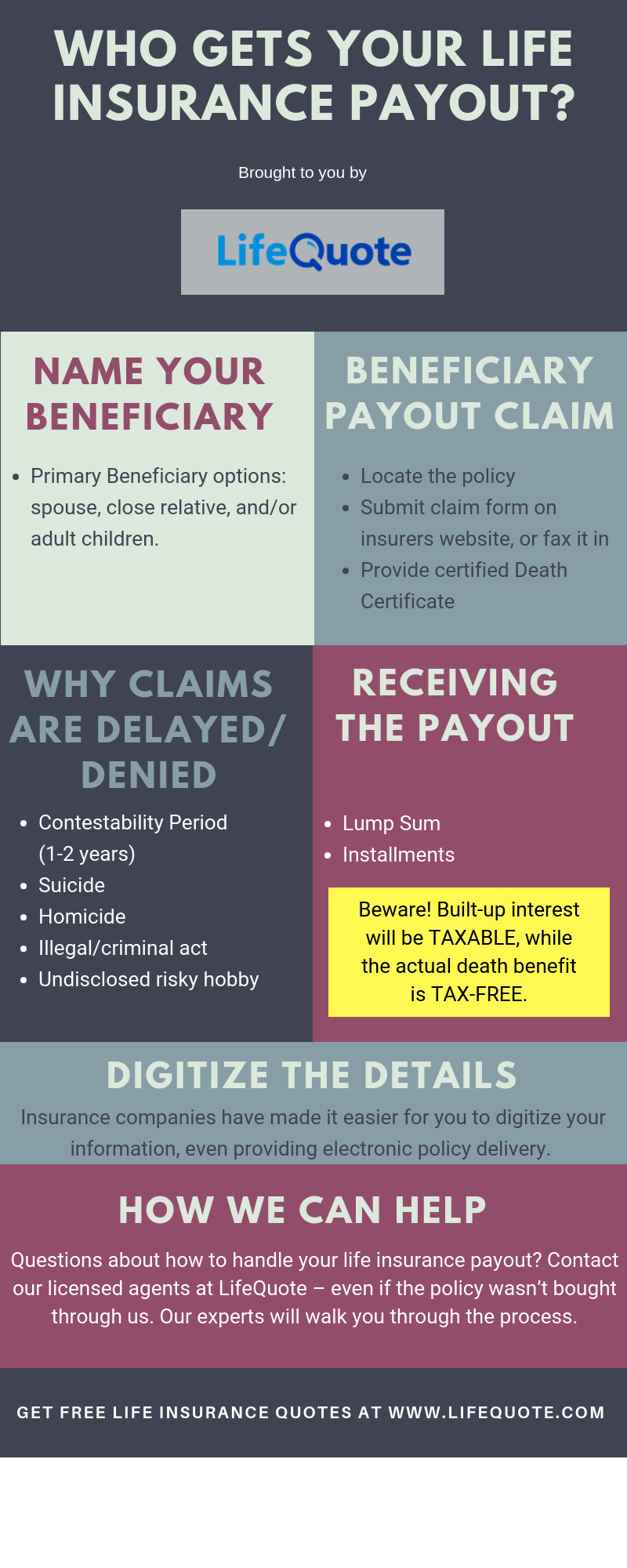

Who Gets Life Insurance Payout Make Sure Your Beneficiary Gets Paid

Who Gets Life Insurance Payout Make Sure Your Beneficiary Gets Paid

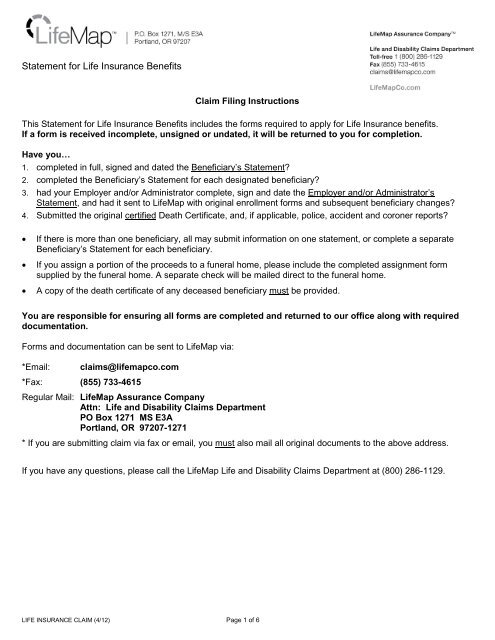

Life Insurance Claim Form Lifemap

Life Insurance Claim Form Lifemap

Claiming Life Insurance Benefits Pdf Free Download

Claiming Life Insurance Benefits Pdf Free Download

Word Writing Text Life Insurance Business Concept For Payment Of

Word Writing Text Life Insurance Business Concept For Payment Of

Death Claim Is It Possible To Claim From More Than One Life

Death Claim Is It Possible To Claim From More Than One Life

Comments

Post a Comment