Generally speaking investing life insurance proceeds should not really be approached any differently than other investments. And avoid putting life insurance proceeds into an irreversible fund you cant access.

How To Invest Life Insurance Proceeds In 2020

How To Invest Life Insurance Proceeds In 2020

Uren points out that you will have time to make investment moves once things become clearer.

How to invest life insurance proceeds. And avoid putting life insurance proceeds into an irreversible fund you cant access. When it comes to considering life insurance as an investment youve probably heard the adage buy term and invest the difference this advice is based on the idea that term life insurance. Usually when a person receives insurance proceeds from a life insurance policy due to the death of the insured person the payout isnt taxable and you arent required to report it as income.

A married couple has one spouse who is a stay at home parent who generates no income. How to invest life insurance proceeds july 6 2017 by tony steuer there are many articles about how much life insurance to buy or what type of life insurance to buy however there are so many other issues to consider with life insurance. How should the surviving spouse invest the life insurance proceeds.

Tread carefully when you help clients decide what to do with their life insurance proceeds after a loved one dies. The use of a retained asset account one of the most popular methods of. 5 smart ways to invest an insurance payout.

How a surviving spouse should invest his or her life insurance proceeds is going to depend on his or her age age of children if any goals current lifestyle risk tolerance and employment situation. Uren points out that you will have time to make investment moves once things become clearer. You just found out that your long lost great uncle died and he left you as beneficiary on his life insurance policy.

The money isnt enough to storm your bosss office to quit but its too much to blow on a new wardrobe and a tropical vacation. The income generating spouse dies at age 30 with an appropriately sized life insurance policy. For these reasons its rare to find an expert who would recommend life insurance as the main investment for retirement or other major goal.

Its a tricky question and i dont have a perfect answer. So what are your options. How to manage life insurance as an investment.

Unclaimed Life Insurance Payouts Top 1 Billion

Unclaimed Life Insurance Payouts Top 1 Billion

Best Ways To Manage Life Insurance Proceeds After A Spouse Dies

Best Ways To Manage Life Insurance Proceeds After A Spouse Dies

Goodman Triangle The Unholy Trinity Of Life Insurance

Goodman Triangle The Unholy Trinity Of Life Insurance

Life Insurance Policy Taxability Tax Benefits

Life Insurance Policy Taxability Tax Benefits

Moneycation Life Insurance Better Return On Investment Than The

Moneycation Life Insurance Better Return On Investment Than The

/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg) Understanding Taxes On Life Insurance Premiums

Understanding Taxes On Life Insurance Premiums

Vul For As Low As Php 50 Per Day My Wise Finances

Vul For As Low As Php 50 Per Day My Wise Finances

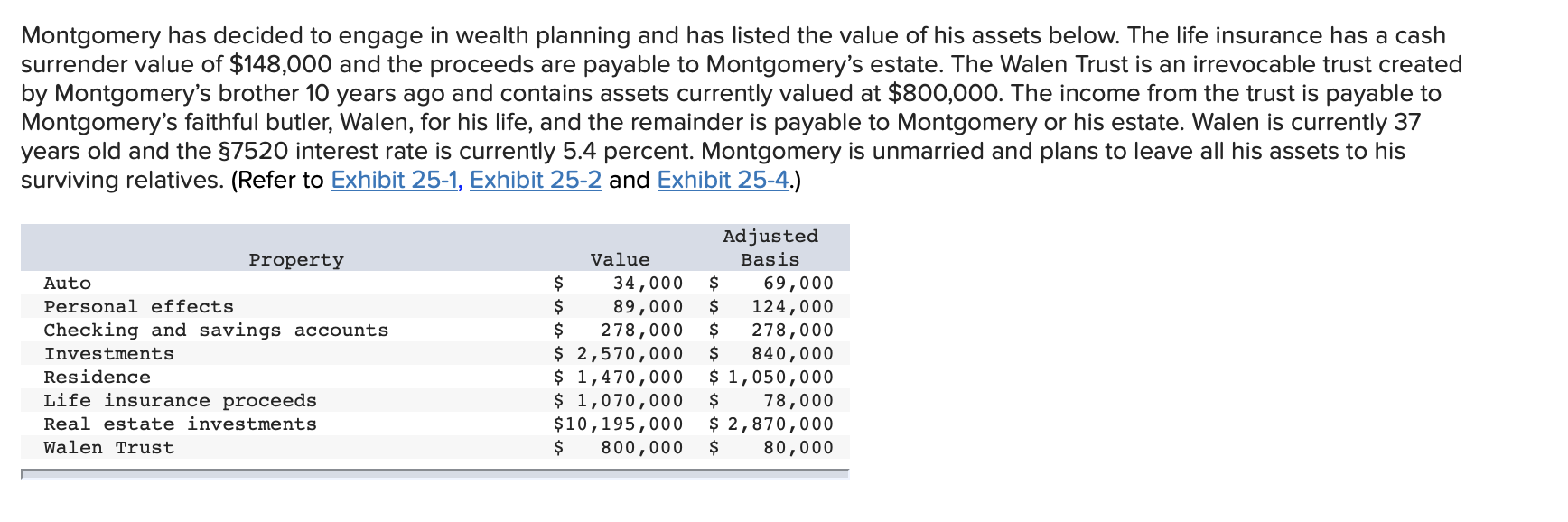

Montgomery Has Decided To Engage In Wealth Plannin Chegg Com

Montgomery Has Decided To Engage In Wealth Plannin Chegg Com

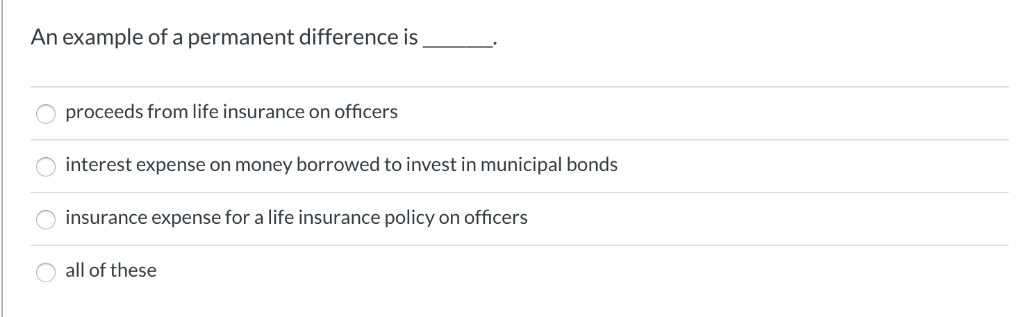

Solved An Example Of A Permanent Difference Is Proceeds F

Solved An Example Of A Permanent Difference Is Proceeds F

What Is Vul Insurance And Should You Get One Moneymax Ph

What Is Vul Insurance And Should You Get One Moneymax Ph

Life Insurance V S Mutual Funds Which Is The Better Investment

Life Insurance V S Mutual Funds Which Is The Better Investment

What Are The 5 Reasons To Invest In Child Insurance Quora

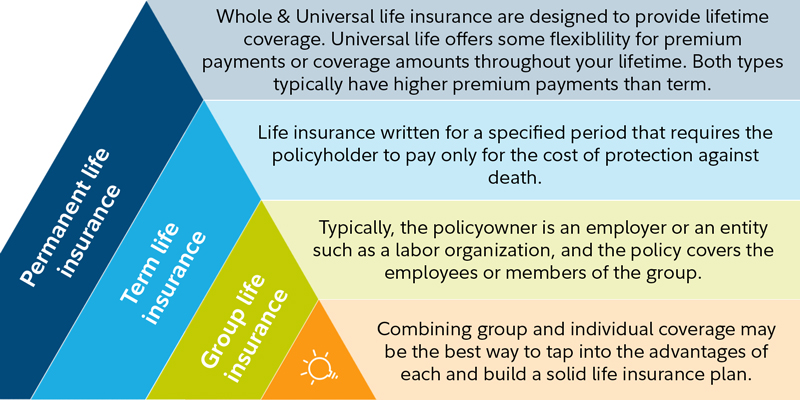

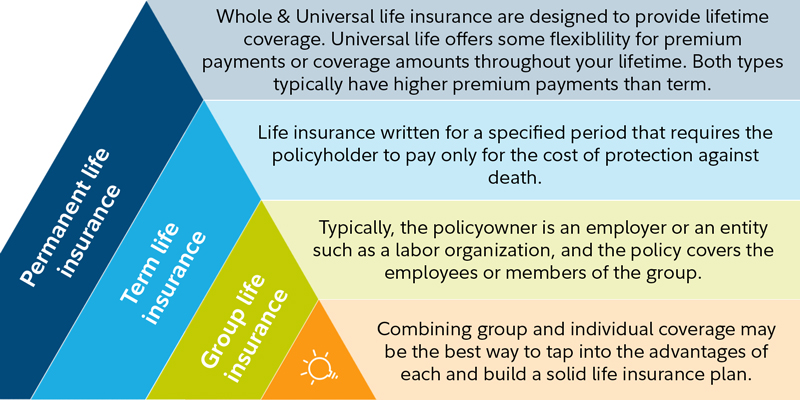

Layering Life Insurance Policies Fidelity Investments

Layering Life Insurance Policies Fidelity Investments

How A Life Insurance Payout Actually Works Mason Finance

How A Life Insurance Payout Actually Works Mason Finance

The Pros And Cons Of Whole Life Insurance

The Pros And Cons Of Whole Life Insurance

Building A Stronger Investment Portfolio Ppt Download

Building A Stronger Investment Portfolio Ppt Download

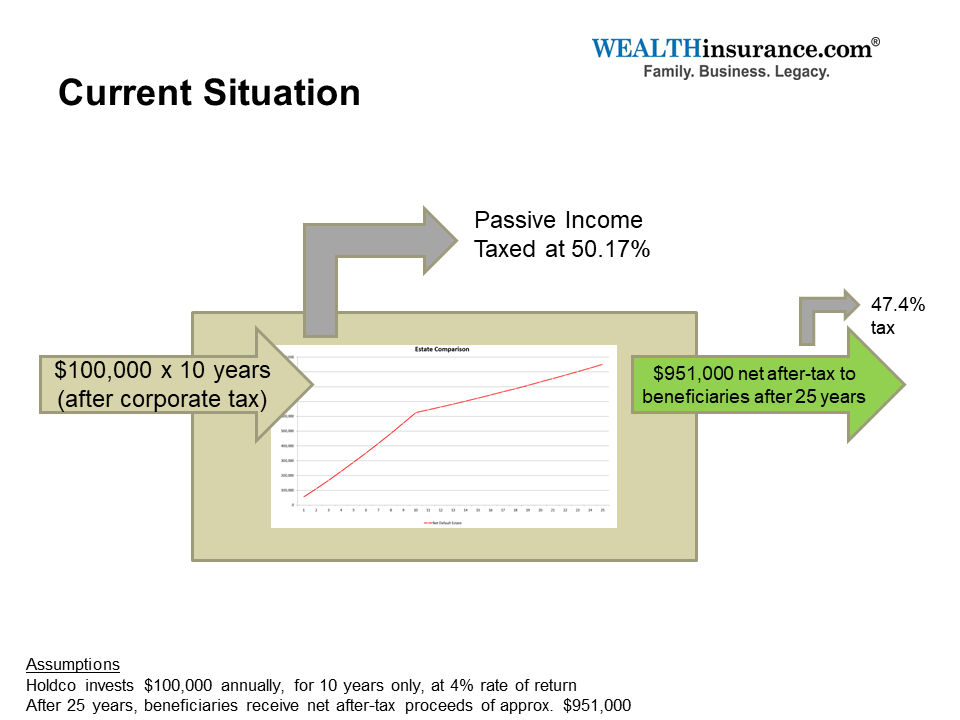

Tax Exempt Life Insurance Investment

Tax Exempt Life Insurance Investment

Life Insurance Through Super A Definitive Guide

Life Insurance Through Super A Definitive Guide

:max_bytes(150000):strip_icc()/GettyImages-475702616-3d8d1ec251704afbbd1a3f9580d63bcb.jpg)

Comments

Post a Comment