The cost of employer provided group term life insurance on the life of an employees spouse or dependent paid by the employer is not taxable to the employee if the face amount of the coverage does not exceed 2000. Life insurance imputed income is a commonly used phrase.

Understanding Life Insurance And Imputed Income

Understanding Life Insurance And Imputed Income

There are advantages to buying group life insurance if you stick below the 50000 threshold.

Imputed life insurance income. Imputed income for term life insurance in excess of 50000. Youre probably familiar with the concept of providing pre tax benefits to your employees such as. Why to buy individual life insurance.

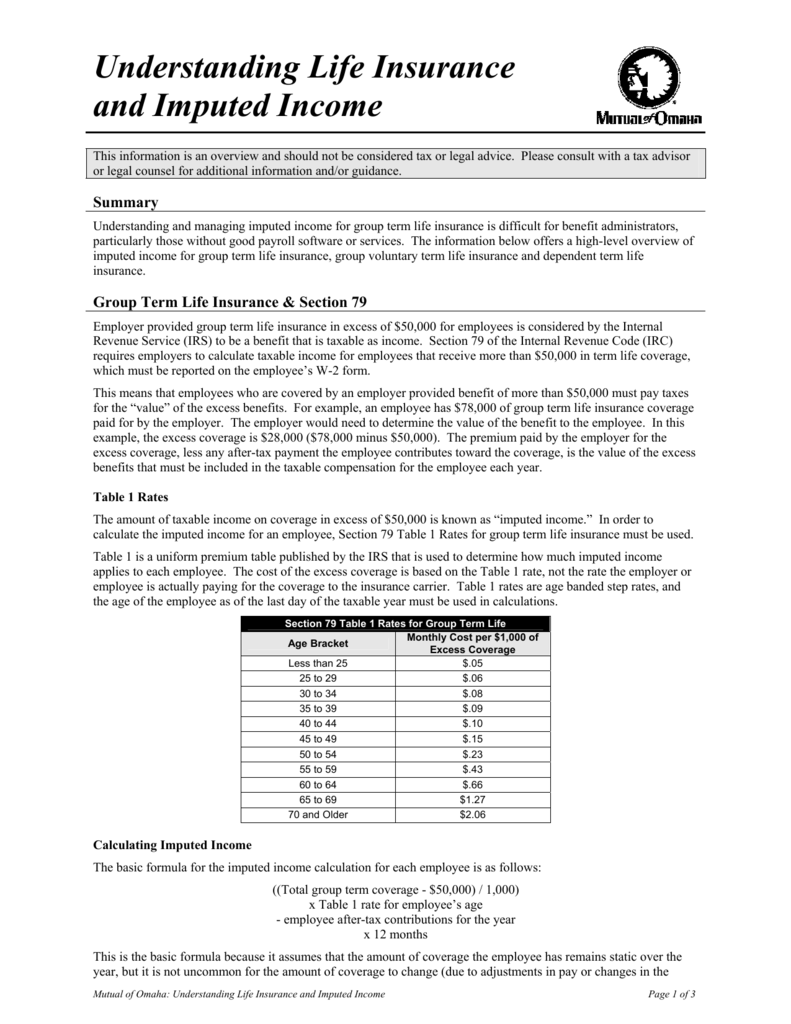

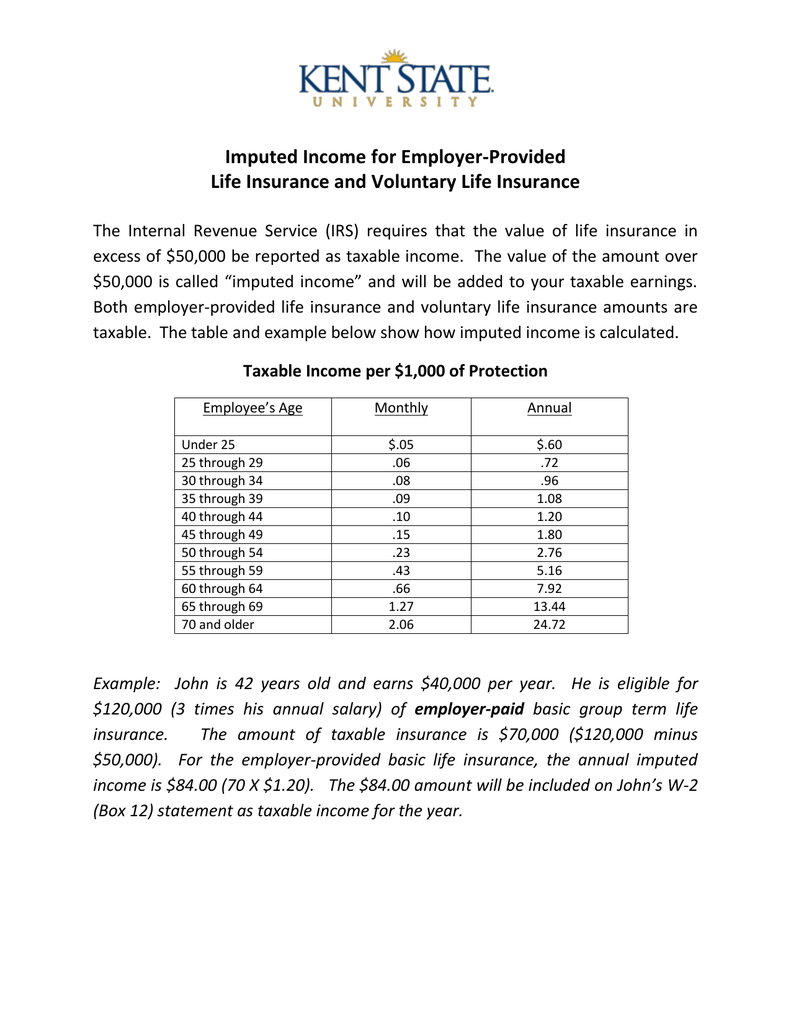

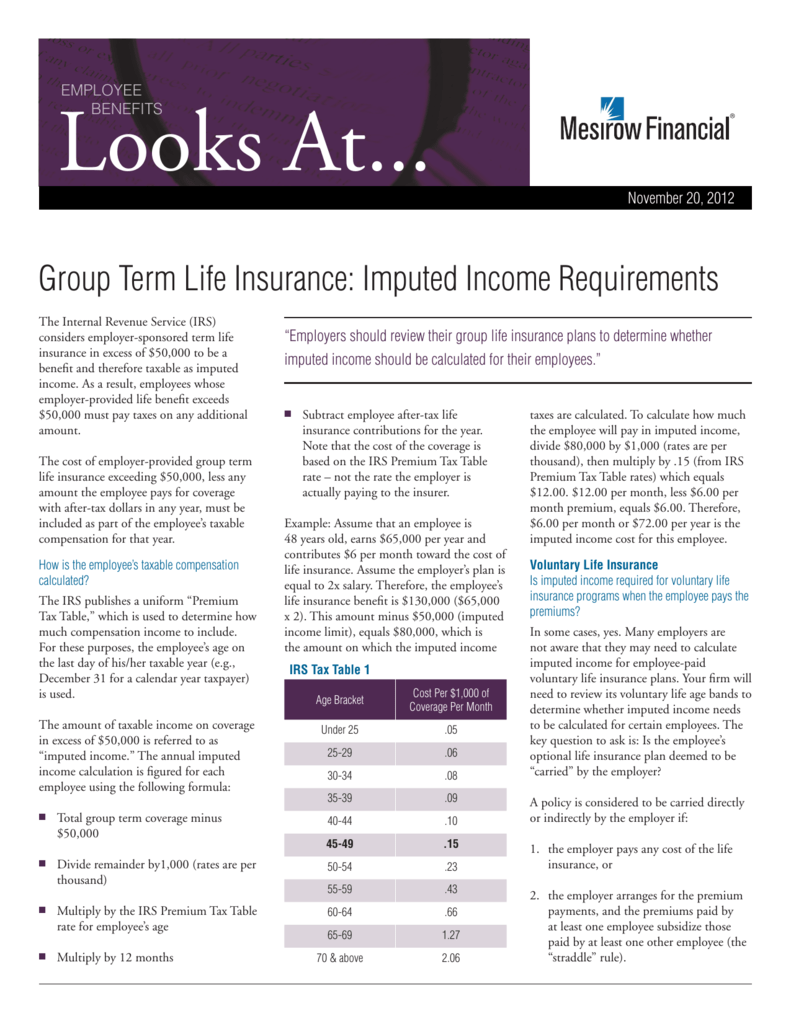

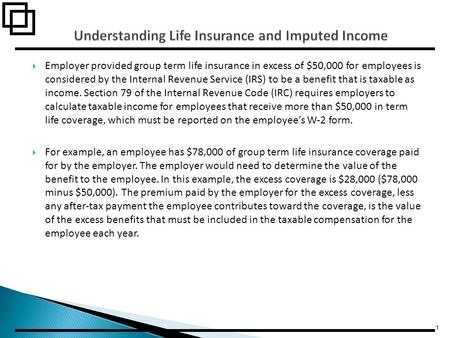

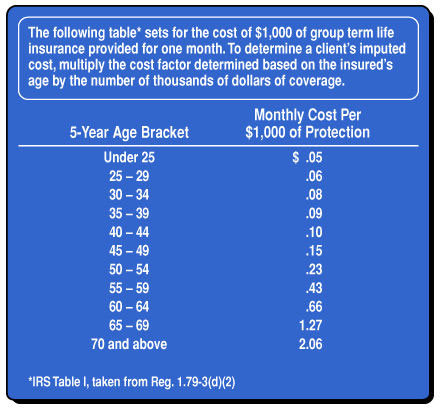

Section 79 of the internal revenue code irc requires that employers calculate imputed taxable income for employees that receive group life insurance coverage in excess of 50000. According to internal revenue service section 79 if an employee receives more than 50000 of group term life insurance under a policy carried by his employer the imputed cost of coverage over 50000 is considered taxable income and is subject to social security and medicare taxes. Imputed income is the dollar value that irs puts on the amount of group term life insurance coverage in excess of 50000.

The information below offers a high level overview of imputed income for group term life insurance group voluntary term life insurance and dependent term life insurance. Life insurance coverage for any employee above 50000. It then carves out a limited exception for the cost of up to 50000 of group term life insurance coverage per employee.

The imputed income occurs when individuals with more than 50000 of life coverage volume insurance pay less for the coverage than the irs has determined to be worth as per the. The amount of imputed taxable income must be reported on the employees form w 2. Life insurance is a benefit commonly offered by employers.

Understanding and managing imputed income for group term life insurance is difficult for benefit administrators particularly those without good payroll software or services. So what is it and how does it work. This coverage is excluded as a de minimis fringe benefit.

However very few people understand what it means. What this means simply put is that the money that you save by purchasing the group life coverage at a lower rate is washed because of the amount of taxes you pay on the imputed income. If you provide group term life insurance to your employees you might need to think about imputed income.

So life insurance imputed income refers to any amount paid on the cover above 50000. It applies whenever you provide an employee more than 50000 worth of life insurance. Imputed income for employer provided life insurance.

In 1964 congress adopted code 79 which begins by stating a general rule that the cost of group term life insurance is included in gross income. For your information it describes the value of benefit or service that the irs treats as income. Generally however an employee may choose to have income tax withheld on imputed income each pay period or to pay what is due at the time he files his federal income taxes.

Group Life Insurance Group Life Insurance Taxable Income

Group Life Insurance Group Life Insurance Taxable Income

How Imputed Income Reporting Works With Your Contributory Life

How Imputed Income Reporting Works With Your Contributory Life

Imputed Income Issues For Employers Leavitt Group News

Imputed Income Issues For Employers Leavitt Group News

Group Life Insurance Group Life Insurance Imputed Income

Group Life Insurance Group Life Insurance Imputed Income

Life Insurance Tax Calculator Imputed Income For Dynamics Gp

Life Insurance Tax Calculator Imputed Income For Dynamics Gp

Calculating Imputed Income On Group Term Life Insurance Goco Io

Calculating Imputed Income On Group Term Life Insurance Goco Io

Section 79 Employee Paid Term Life Ghb Insurance

Section 79 Employee Paid Term Life Ghb Insurance

Life Insurance Deviation Child Support Lawyers Atlanta Duluth

Life Insurance Deviation Child Support Lawyers Atlanta Duluth

How To Set Up Sap Hcm Configuration For Imputed Income Calculation

How To Set Up Sap Hcm Configuration For Imputed Income Calculation

Imputed Income For Employer Provided Life Insurance And Voluntary

Imputed Income For Employer Provided Life Insurance And Voluntary

Https Www Archstl Org Portals 0 Documents Parish Administrative Services Imputed 20income 20 20qb 20payroll Pdf Ver 2018 08 10 132949 247

Group Life Insurance Group Life Insurance Imputed Income

Group Life Insurance Group Life Insurance Imputed Income

Does Imputed Income Affect Your Contributory Life Insurance Plan

Does Imputed Income Affect Your Contributory Life Insurance Plan

Https Www Vanderbilt Edu Skyvu Quick Ref Guide Oracle Paycheck Pdf

W 2 Form For Calendar Year 1996

W 2 Form For Calendar Year 1996

Group Term Life Insurance Table I Straddle Testing And Imputed

Group Term Life Insurance Table I Straddle Testing And Imputed

Group Term Life Insurance Imputed Income

Group Term Life Insurance Imputed Income

Life Insurance Patti Nash Objectives Identify Different Methods

Life Insurance Patti Nash Objectives Identify Different Methods

Imputed Income Issues For Employers Leavitt Group News

Imputed Income Issues For Employers Leavitt Group News

Comments

Post a Comment