There are so many that it can often be hard to work out which one is the right one for you. The size of the payout however depends on the type of policy as well as the unique circumstances of the policy holder.

Increasing Number Of Under 35s Take Out Life Insurance Your Money

Increasing Number Of Under 35s Take Out Life Insurance Your Money

Choosing life insurance can be considered a morbid activity but actually when you compare decreasing term life insurance you are able to weigh up the pros and cons of each providers policies.

Increasing life insurance. Consider the costs and what will be required to. Using a needs analysis and finding out what your options are through your employer or with your current life insurance coverage can give you some options. A life insurance policy doesnt have to be expensive on average we found that people we helped could find a quote from as little as 1355 a month.

For example an annual renewable term life policy is very affordable but premiums increase annually. If the type of life insurance policy you have is no longer meeting your needs then you may have to look for additional options for increasing your current coverage. Unlike term life insurance policies which do not build cash value and always have a levelized death benefit permanent life insurance policies allow policy owners to select levelized or.

How to increase existing life insurance. Increasing life insurance. When you compare decreasing term life insurance youll be asked about your personal circumstances and health.

Our life insurance products offer cover up to age 90 with a maximum policy length of up to 50 years. Normally decreasing term life insurance is taken to enable the policy holders dependents to pay off an outstanding debt that is going down. As the name suggests with traditional increasing term life cover amount insured increases each year by a fixed amount for the length of the policy.

50 of people could achieve a quote of 1355 per month for their life insurance for up to 100000 worth of cover based on compare the market data in november 2019. Decreasing term insurance is a more affordable option than whole life or universal life insurancethe death benefit is designed to mirror the amortization schedule of a mortgage or other high. Term life policies such as 10 20 30 35 year term policies do not increase until the term is completed.

A life insurance policy of any kind is designed to pay out an amount of money upon the death of the policy holder. For more information visit the protective life learning. Aims to pay out a cash sum thats protected against inflation if your client dies while covered by the policy.

If you think you might need more life insurance youre probably right. There are several different types of life insurance plans out there. This article looks at a few options you may have for adding to your overall life insurance coverage as your life changes.

Life insurance only increases on certain types of plans.

Final Expense Almost Guaranteed Issue Life Insurance Get Buried

Final Expense Almost Guaranteed Issue Life Insurance Get Buried

Varying Benefit Insurance Issued Life Contingencies Lecture

Varying Benefit Insurance Issued Life Contingencies Lecture

Increasing Term Insurance Can I Opt For Increasing Term Life

Increasing Term Insurance Can I Opt For Increasing Term Life

Kotak Life Insurance Launches Annual Guaranteed Income Product

Kotak Life Insurance Launches Annual Guaranteed Income Product

Pdf Opinion Leaders For Increasing The Market For Non Life

Pdf Opinion Leaders For Increasing The Market For Non Life

What You Need To Know About Increasing Term Life Insurance Farm

What You Need To Know About Increasing Term Life Insurance Farm

Increasing Life Insurance Sales Tips To Battle The Holidays

Increasing Life Insurance Sales Tips To Battle The Holidays

Transamerica Increasing Charges On Life Insurance Policies By 40

Transamerica Increasing Charges On Life Insurance Policies By 40

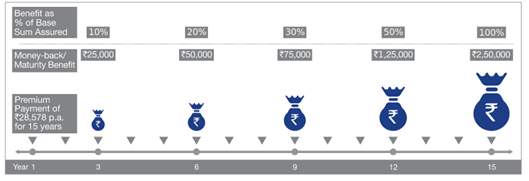

Reliance Nippon Life Increasing Money Back Plan Comparepolicy Com

Reliance Nippon Life Increasing Money Back Plan Comparepolicy Com

Guide To Purchasing Life Insurance

Guide To Purchasing Life Insurance

Increasing Premium Term Life Insurance Authorstream

Increasing Premium Term Life Insurance Authorstream

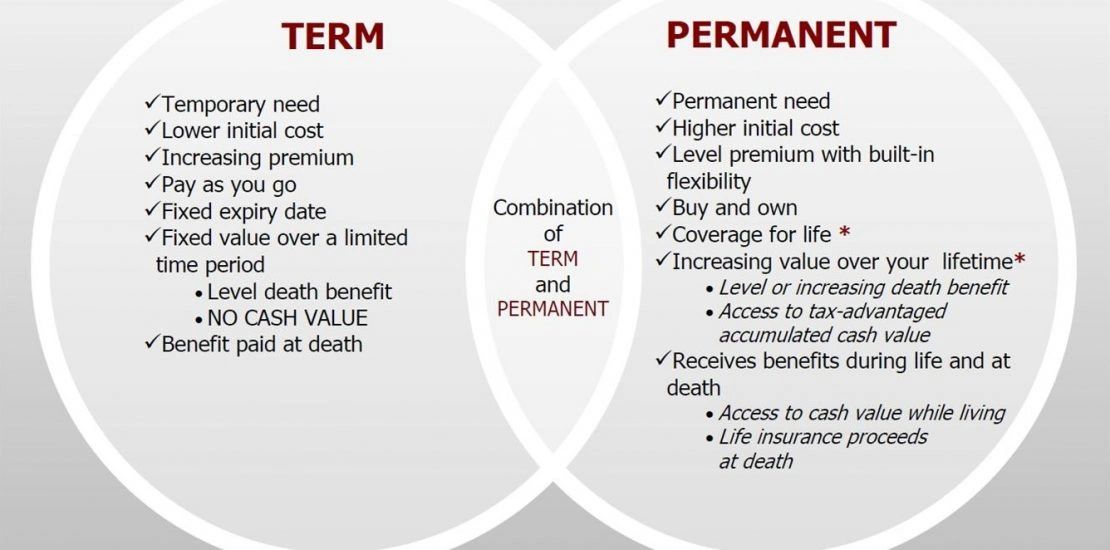

Term Versus Permanent Insurance 2

Term Versus Permanent Insurance 2

12 1 Unique Characteristics Of Life Insurance 1 The Event Insured

12 1 Unique Characteristics Of Life Insurance 1 The Event Insured

The Three Primary Types Of Term Life Insurance Aaron Peacock

The Three Primary Types Of Term Life Insurance Aaron Peacock

Compare Stepped Vs Level Life Insurance Premiums

Compare Stepped Vs Level Life Insurance Premiums

Ceylinco Life Is Breathing Life Into Sri Lanka S Life Insurance

Ceylinco Life Is Breathing Life Into Sri Lanka S Life Insurance

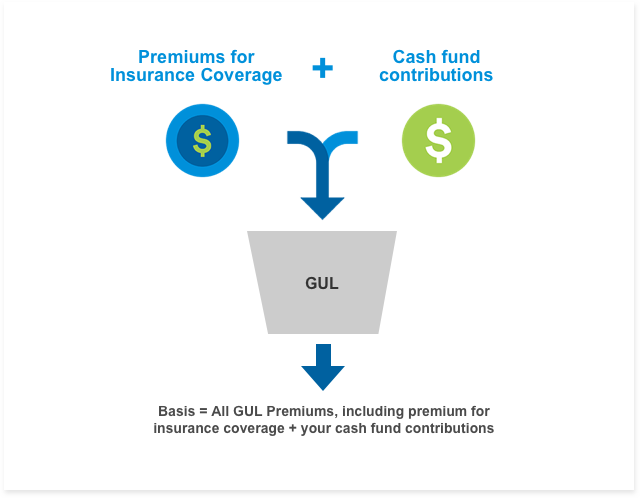

Life Insurance Overview Group Universal Life Metlife

Life Insurance Overview Group Universal Life Metlife

Life Insurance Industry Sees Increasing M A Activity Money

Life Insurance Industry Sees Increasing M A Activity Money

How Much Life Insurance Do I Need Should My Kids Be Protected

How Much Life Insurance Do I Need Should My Kids Be Protected

Financial Awareness Pushing Millennials To Invest In Life Insurance

Financial Awareness Pushing Millennials To Invest In Life Insurance

Comments

Post a Comment