Whole life insurance or whole of life assurance in the commonwealth of nations sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in force for the insureds entire lifetime provided required premiums are paid or to the maturity date. Whole life is the most common type of permanent life insurance.

When To Buy Whole Life Insurance Singapore Blog Pang Zhe Liang

When To Buy Whole Life Insurance Singapore Blog Pang Zhe Liang

We are committed to recommending the best products for our readers.

Insurance whole life. Whole life insurance gives a policyholder lifetime coverage and a guaranteed amount to pass on to beneficiaries so long as the contract is up to date at the time or the policyholders death. With whole life insurance your premium payments remain the same over the life of the policy. The policy is structured to last your entire life and as long as you keep paying the premiums the policy will be in force regardless of age and health.

Whole of life insurance is designed so the policy pays out a lump sum to your loved ones when you die. Whole of life insurance will pay a tax free lump sum to your loved ones in the event of your death. This type of life insurance guarantees a pay out because it covers you for life so quotes are often pricer than term insurance premiums.

You can choose how often youd like to make premium payments too annually semiannually quarterly or monthly. What are the advantages of this approach over other policies. Like most permanent life insurance policies whole life also offers a savings component called cash value read on to learn more about the benefits of whole life insurance.

Whole life insurance is the most common type of permanent life insurance policy that people purchase according to the insurance information institute iii. Whole of life insurance is designed to last as long as you do. Talk to your agent about ways whole life insurance from farmers new world life insurance company may help you reach your goals.

Whole life insurance policy provides life cover throughout the policyholders lifetime. Check benefits eligibility criteria riders and buy the best whole life plan for you and your family. The guaranteed death benefit is payable to the nominee on the death of the life assured.

Best whole life insurance policies of 2020 protect your family for life with stable premiums. You pay in a premium every month and when you die the policy pays out a. As long as you continue paying your premium it may be a way to help prepare for the future and provide for heirs.

Whole life is permanent insurance that might be a good option. We may receive compensation when you click on links to products but this never affects our reviews or recommendations. Whole life insurance premiums while higher initially never go up this is key.

Do Not Need To Die To Benefit From Whole Life Insurance Delgado

Do Not Need To Die To Benefit From Whole Life Insurance Delgado

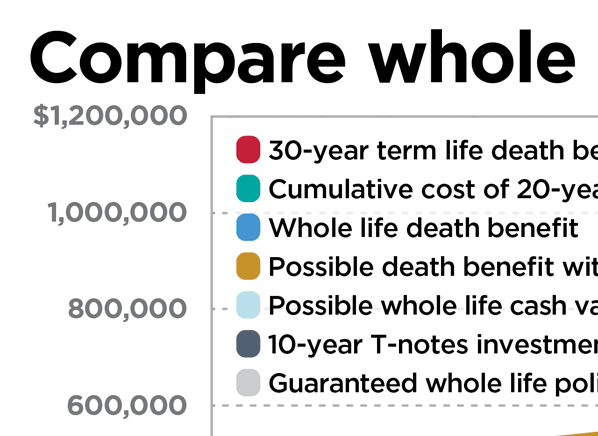

Term Vs Whole Life Insurance Which Is Better

Term Vs Whole Life Insurance Which Is Better

Whole Life Insurance Whole Life Policy Whole Life Insurance Plans

Whole Life Insurance Whole Life Policy Whole Life Insurance Plans

This Is For Your Newborn Baby Should You Get Whole Life Or Term Life

This Is For Your Newborn Baby Should You Get Whole Life Or Term Life

What Is Term Life Insurance Daveramsey Com

What Is Term Life Insurance Daveramsey Com

Best Whole Life Insurance 2020

Best Whole Life Insurance 2020

Is Whole Life Insurance A Good Idea For My Family

Is Whole Life Insurance A Good Idea For My Family

Limited Pay Whole Life Insurance

Limited Pay Whole Life Insurance

Whole Life Insurance Definition And Meaning Market Business News

Whole Life Insurance Definition And Meaning Market Business News

Term Life Insurance Vs Whole Life Insurance

Term Life Insurance Vs Whole Life Insurance

Term Life Insurance Vs Whole And Universal Life Insurance Policies

Term Life Insurance Vs Whole And Universal Life Insurance Policies

Family Protection Starts By Having Life Insurance Whole Life

Family Protection Starts By Having Life Insurance Whole Life

Term Insurance Vs Whole Life Insurance What Is Insurance How

Term Insurance Vs Whole Life Insurance What Is Insurance How

Whole Life Insurance Is A Bad Investment

Whole Life Insurance Is A Bad Investment

12 Questions To Ask Before Purchasing Whole Life Insurance The

12 Questions To Ask Before Purchasing Whole Life Insurance The

Search Q Cash Value Whole Life Insurance Tbm Isch

How Much Does Whole Life Insurance Cost Effortless Insurance

How Much Does Whole Life Insurance Cost Effortless Insurance

The Incredible Flexibility Of Blended Whole Life Insurance

The Incredible Flexibility Of Blended Whole Life Insurance

Whole Life Policies For Dummies Are They A Good Way To Insure

Whole Life Policies For Dummies Are They A Good Way To Insure

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Term Vs Whole Life Insurance Which Is Better Market Business News

Term Vs Whole Life Insurance Which Is Better Market Business News

Tom Mcfie On Universal Life Insurance And Whole Life Insurance

Tom Mcfie On Universal Life Insurance And Whole Life Insurance

Comments

Post a Comment