Life insurance plans are one of the most protected pieces of property a person can own. This type of life insurance policy earns interest on the savings account side which in turn earns interest.

Are Life Insurance Premiums Tax Deductible Fwd Philippines

Are Life Insurance Premiums Tax Deductible Fwd Philippines

A life insurance policy loan is not taxable as income as long as it doesnt exceed the amount paid in premiums for the policy.

Interest on life insurance policy taxable. Of the life insurance company prior to a lapse to find out the amount of interest earnings before you make such a decision. Since the proceeds of the loan were used for investment is the interest deductible as investment interest. When the policy is up the premiums paid over the previous decades are returned to the policyholder.

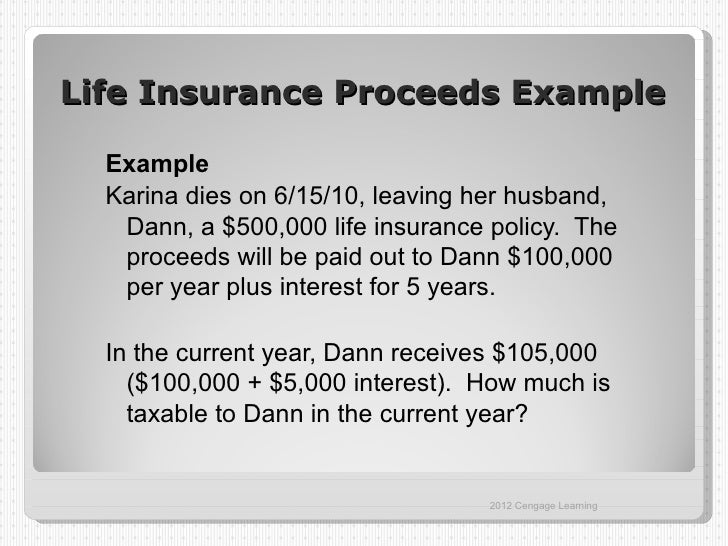

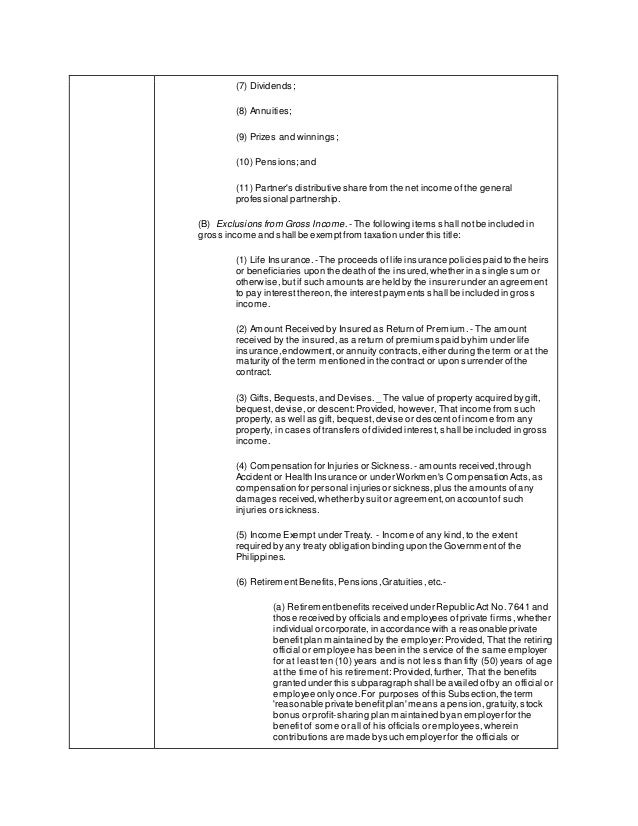

Is accrued interest on a life insurance payout subject to federal income tax. Life insurance proceeds typically pay out tax free to the beneficiary. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it.

But there are certain. Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away. Does a life insurance policy earn interest or dividends.

Return of premium life insurance life insurance policies do just what they say. Interest earnings within a life insurance policy are not taxable as are loans against the policy. Is return of premium life insurance taxable.

By law life insurance companies must maintain a cash reserve against their obligation to pay death claims. The indexed universal life insurance policy gives you life insurance protects you from down markets as well as serves as a tax haven. One of the protections is that gains via interest and dividends if in a participating usually mutual company plan are not taxable as long as they are in the policy.

However the entire interest earnings will be taxable if the policy lapses for any reason therefore you will want to contact the customer service dept. Is the loan interest added to basis to reduce the taxable portion of the gain on the. Getting a large lump sum of money usually incurs taxes think lotto winnings for example.

You are also earning interest on the amount that you would have had to pay in taxes. Insurers do this by taking insurance premiums from policy holders pooling them in the general account of the insurance company and then investing them. I used the proceeds from a whole life insurance policy loan to invest in real estate.

The policy was paid up and cashed in and the cash surrender value was reduced by the accrued interest on the loan. If you surrender your policy or your policy lapses the loan plus. Insurance companies may offer a number of ways.

Most of the time proceeds arent taxable.

How To Calculate The Cash Surrender Value

How To Calculate The Cash Surrender Value

What Is Universal Life Insurance Daveramsey Com

What Is Universal Life Insurance Daveramsey Com

Prudential Life Insurance Surrender Form Is Life Insurance

Prudential Life Insurance Surrender Form Is Life Insurance

/GettyImages-475702616-3d8d1ec251704afbbd1a3f9580d63bcb.jpg) The Truth About Endowment Life Insurance Policies

The Truth About Endowment Life Insurance Policies

Special Laws Taxation Part 1 Ra 8424 Only

Special Laws Taxation Part 1 Ra 8424 Only

Ppt A Dozen Uses Of Life Insurance In Estate Planning Powerpoint

Ppt A Dozen Uses Of Life Insurance In Estate Planning Powerpoint

Are Life Insurance Premiums Tax Deductible Quotacy

Are Life Insurance Premiums Tax Deductible Quotacy

How To Rescue A Life Insurance Policy With A Loan

How To Rescue A Life Insurance Policy With A Loan

How A Life Insurance Payout Actually Works Mason Finance

How A Life Insurance Payout Actually Works Mason Finance

Are Life Insurance Loans A Bad Idea

Are Life Insurance Loans A Bad Idea

Taxation Of Life Insurance Part Iii Loans Youtube

Taxation Of Life Insurance Part Iii Loans Youtube

Are Life Insurance Death Benefits Taxable Income Finance Zacks

Are Life Insurance Death Benefits Taxable Income Finance Zacks

Bank Owned Life Insurance A Primer For Community Banks

Bank Owned Life Insurance A Primer For Community Banks

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Irrevocable Life Insurance Trust Ilit The Wealth Counselor

Irrevocable Life Insurance Trust Ilit The Wealth Counselor

Http Www Ntrc Gov Ph Images Publications Guide To Philippine Taxes 2016 Income Taxes Pdf

Ppt Chapter 18 Buying Life Insurance Powerpoint Presentation

Ppt Chapter 18 Buying Life Insurance Powerpoint Presentation

Calameo What Is Whole Life Insurance

Calameo What Is Whole Life Insurance

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

5 Important Life Insurance Exclusions

5 Important Life Insurance Exclusions

Comments

Post a Comment