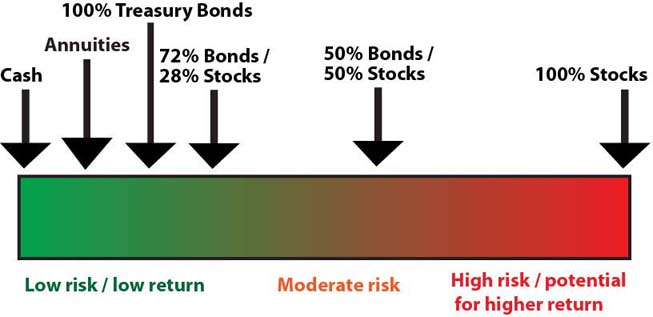

Cash value life insurance can be a way to supplement other investment types youve maxed out such as 401k retirement savings. Anyone talking about using life insurance as an investment is talking about a permanent life insurance policy most likely a whole life insurance policy.

Five Dangers Associated With Using Cash Value Life Insurance

Five Dangers Associated With Using Cash Value Life Insurance

You have a need for it or will have a need for it.

Is cash value life insurance a good investment. When is whole life insurance a good investment strategy. Cash value life insurance makes sense if. But policy charges can significantly eat into the money that would otherwise go to cash value.

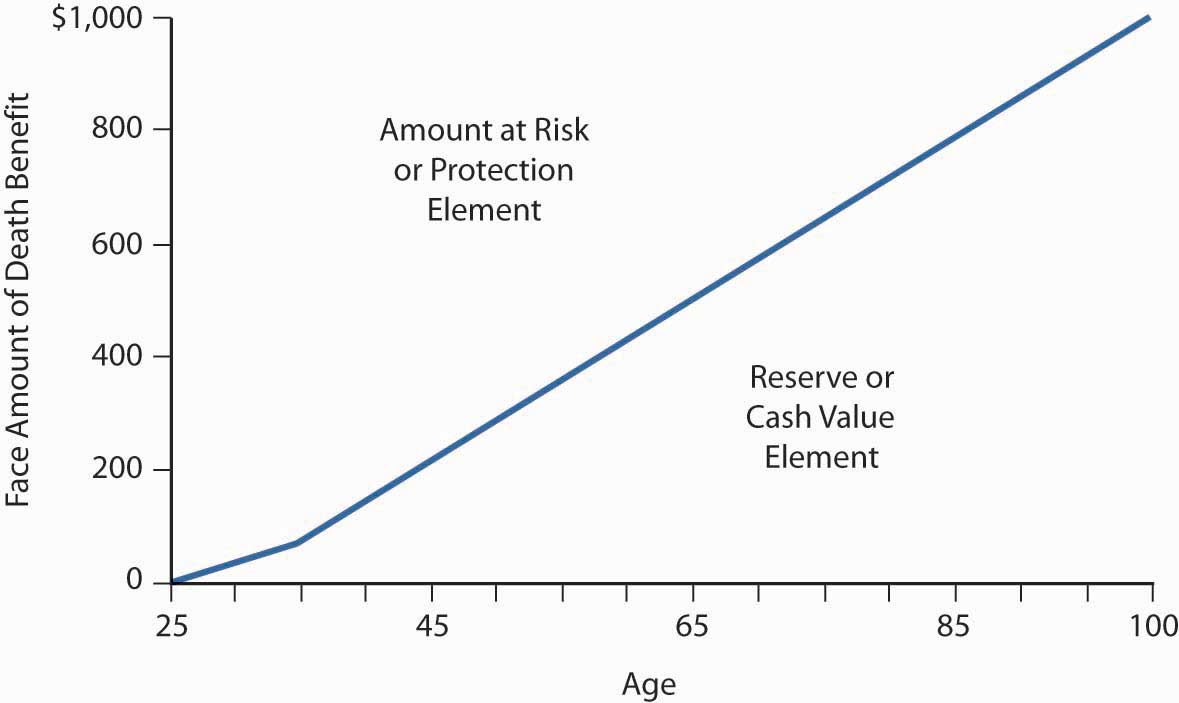

Is cash value life insurance a good investment. If youve built up a sizable cash value you may also choose to take out a loan against your policylife insurance companies often offer these cash value loans at interest rates lower than a. A portion of that 100 covers the cost of actually insuring your life and the rest is put into investments by the insurance company.

Cash value has a nice ring to it when youre thinking about buying life insurance but youll need to do some careful analysis to learn whether a cash value policy is. When you hear financial advisers and more often life insurance agents advocating for life insurance as an investment they are referring to the cash value component of permanent life insurance. Miranda marquit is a personal finance blogger.

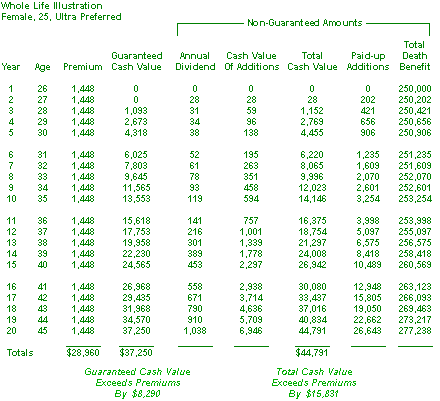

Whole life policy accumulates cash value in the form of. Whole life insurance differs from term life insurance in two major ways. Heres a comparison of whole life insurance and term life insurance.

When you take out the policy your premiums are fixed for life. In the end whether or not cash value life insurance represents a good investment for you largely depends on your financial goals and the role that your insurance policies play in reaching them. Cash value works like this.

Ie you have dependents. If you expect to carry life insurance for the rest of your life a cash value policy can be a good investment. Say youre paying 100 a month for your cash value life insurance policy.

You are already fully maxing out your ira and 401k. Buy term and invest the rest is something you will hear all the time but actually cash value life insurance is a very misunderstood useful financial product. It doesnt expire and it has a cash value portion.

Make sure you understand all the policy charges before you buy. Before you decide carefully weigh your options.

Term Insurance Vs Whole Life Insurance Policy

Term Insurance Vs Whole Life Insurance Policy

Can You Build Your Wealth Primarily Purchasing Whole Life

Using Cash Value Life Insurance For Retirement Savings Coastal

Using Cash Value Life Insurance For Retirement Savings Coastal

Should I Use Permanent Life Insurance To Invest True Blue

Should I Use Permanent Life Insurance To Invest True Blue

Indexed Universal Life Iul Insurance Policies All You Need To

Indexed Universal Life Iul Insurance Policies All You Need To

10 Things You Absolutely Need To Know About Life Insurance

10 Things You Absolutely Need To Know About Life Insurance

/senior-african-american-couple-paying-bills-487701721-576421a23df78c98dc611ce6.jpg) Is Life Insurance A Good Investment

Is Life Insurance A Good Investment

Life Insurance Products To Avoid

Life Insurance Products To Avoid

Whole Life Insurance What You Need To Know

Whole Life Insurance What You Need To Know

Life Insurance Policies Are Whole Life Insurance Policies A Good

Life Insurance Policies Are Whole Life Insurance Policies A Good

Whole Life Insurance Cash Value Chart

Money Wealth Life Insurance How The Wealthy Use Life Insurance

Money Wealth Life Insurance How The Wealthy Use Life Insurance

Paid Up Additions Work Magic In A Bank On Yourself Plan

Paid Up Additions Work Magic In A Bank On Yourself Plan

Cash Value Life Insurance Policy Loans Not Such A Good Deal

Cash Value Life Insurance Policy Loans Not Such A Good Deal

Ep182 How To Use Cash Value Whole Life Insurance To Buy Real

Ep182 How To Use Cash Value Whole Life Insurance To Buy Real

Whole Vs Term Life Insurance Policygenius

Whole Vs Term Life Insurance Policygenius

Ep182 How To Use Cash Value Whole Life Insurance To Buy Real

Ep182 How To Use Cash Value Whole Life Insurance To Buy Real

Term Life Insurance How Term Life Insurance Works Insurance

Term Life Insurance How Term Life Insurance Works Insurance

Paid Up Additions Work Magic In A Bank On Yourself Plan

Paid Up Additions Work Magic In A Bank On Yourself Plan

Common Misconceptions About Term Insurance Sg Budget Babe Dayre

Common Misconceptions About Term Insurance Sg Budget Babe Dayre

Cash Value Life Insurance Which One Is Best 1 Of 5 Whole Life

Cash Value Life Insurance Which One Is Best 1 Of 5 Whole Life

Comments

Post a Comment