I have been told that is compulsory to have life insurance to obtain a mortgage so that it can be paid off in the event of death but i thought only buildings insurance was compulsory and i have a mortgage elsewhere without it. There are good reasons for this.

10 Things You Absolutely Need To Know About Life Insurance

10 Things You Absolutely Need To Know About Life Insurance

First there is the standard life insurance policy.

Is life insurance compulsory for mortgage. Some lenders require that the borrower has life cover as a condition of their loan. Whether you take out a mortgage life insurance policy is completely up to you. It is important to have a think about how your loved ones would cope with the mortgage debt if you were to pass away.

Was quoted 45 a month and when i said that i would shop around was told that it wasnt worth it as i would have to get lawyers involved to sign over the policy to the bank. If one or both of the borrowers die the loan can be repaid from the life insurance proceeds of the deceased which should mean that any surviving family members dont have to worry. This is a particular type of life assurance taken out for the term of the mortgage and designed to pay it off on the death of the borrower or joint borrower.

A mortgage life insurance policy is designed for peace of mind so that should the worst happen your familys future in your home is secured. Although it usually makes sense to consider taking out life insurance to cover your mortgage loan it is not normally compulsory. Life insurance vs mortgage life insurance vs mortgage protection insurance.

Life insurance compulsory to obtain mortgage. 23rd sep 09 at 1224 pm 1. If you have an existing life insurance policy and want to use it for mortgage protection then you can do so if wish once the cover amount is at least equal to your outstanding mortgage and the term also doesnt cease till the mortgage term matures.

But according to compare the market just 30 of uk adults have life insurance cover equating to 81 million households. While its easy to get cover alongside your mortgage its not compulsory. A mortgage life insurance also known as mortgage protection insurance pays out a lump sum which is sufficiently large to pay off the outstanding debt if you die before the end of the mortgage.

When you get a mortgage to buy your home you will generally be required to take out mortgage protection insurance. Life insurance isnt compulsory but once homeowners take out a mortgage its a recommended product to ensure mortgages are paid off should the policy holder pass away. Mortgage protection insurance.

You can get a term life policy that runs for a set number of years and will pay a set amount if you die during that period. There are a few options if you want life insurance to cover your mortgage. Is mortgage protection necessary if you already have a life insurance policy.

Getting a mortgage and have been advised by the bank that life insurance is compulsory. Do you need life insurance for a mortgage.

Free Health Insurance Quotes No Personal Info Database Kidney

Free Health Insurance Quotes No Personal Info Database Kidney

What Insurance Do You Need With Your Mortgage Money Co Uk

What Insurance Do You Need With Your Mortgage Money Co Uk

Home Loan Insurance Buying Insurance With A Home Loan Is Not

Home Loan Insurance Buying Insurance With A Home Loan Is Not

Ppt Perspectives Of Life Insurance In Azerbaijan Powerpoint

Ppt Perspectives Of Life Insurance In Azerbaijan Powerpoint

Don T Buy Your Next House Till You See This

Don T Buy Your Next House Till You See This

.jpg) Cheap Life Insurance In Spain For Expats

Cheap Life Insurance In Spain For Expats

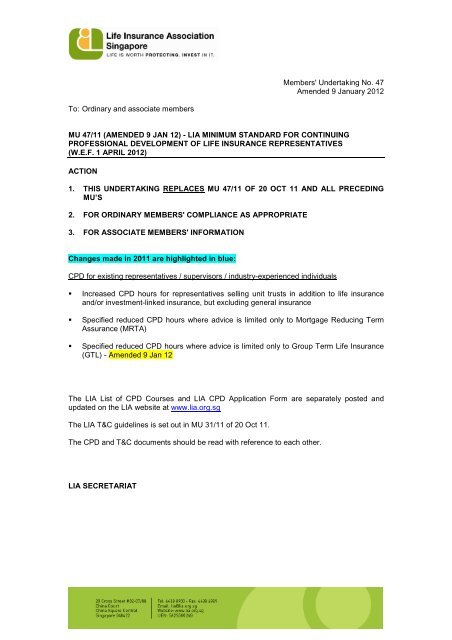

Amended 9 Jan 12 Life Insurance Association Singapore

Amended 9 Jan 12 Life Insurance Association Singapore

Is Car Insurance Mandatory In The United States Ratelab Ca

Is Car Insurance Mandatory In The United States Ratelab Ca

Can You Get A Mortgage Without Life Insurance

Can You Get A Mortgage Without Life Insurance

Halifax Uk First Time Buyers Mortgages

Halifax Uk First Time Buyers Mortgages

Iselect Income Protection Vs Mortgage Protection

Iselect Income Protection Vs Mortgage Protection

Compare Mortgage Protection In Ireland Onequote Ie

Compare Mortgage Protection In Ireland Onequote Ie

Is Mortgage Protection Insurance Necessary When Buying A House

Is Mortgage Protection Insurance Necessary When Buying A House

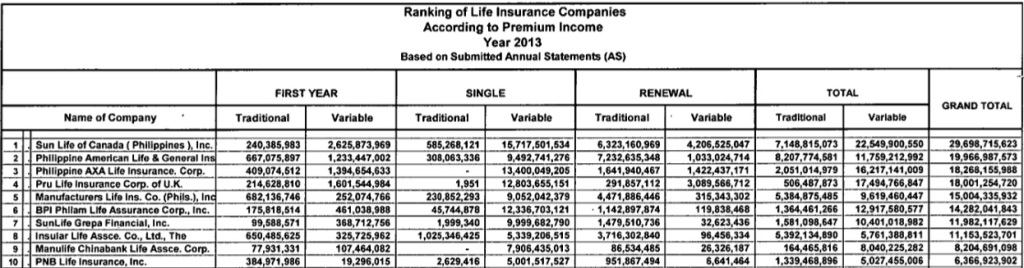

Philippine Insurers And Reinsurers Association Pira Motor

Philippine Insurers And Reinsurers Association Pira Motor

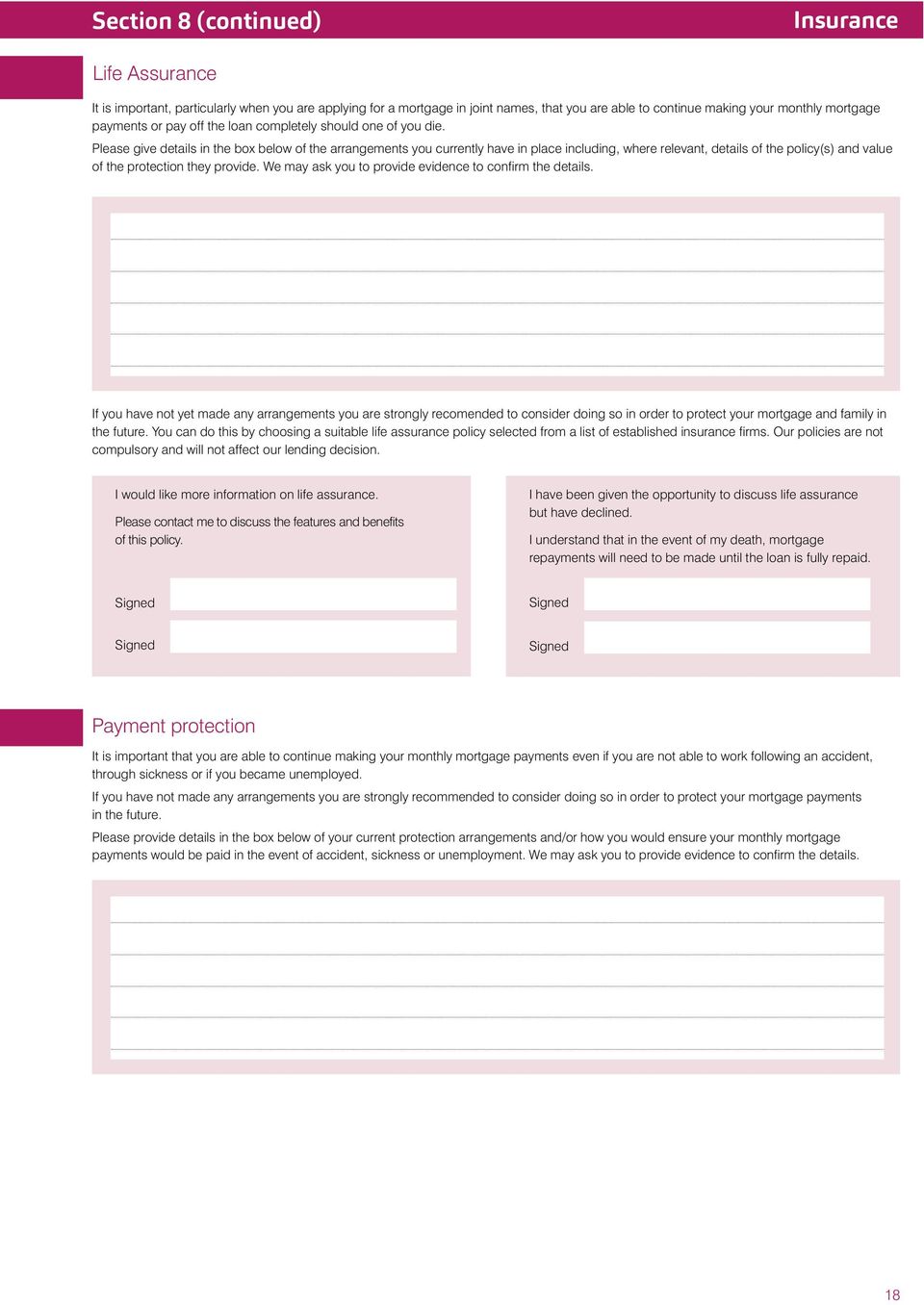

Mortgage Application Form Pdf Free Download

Mortgage Application Form Pdf Free Download

Mortgage Insurance In Singapore The Ultimate Guide For 2020

Mortgage Insurance In Singapore The Ultimate Guide For 2020

If You Have A Loan You Cannot Miss Having A Term Plan The

If You Have A Loan You Cannot Miss Having A Term Plan The

Ppt Mortgage Policy And Real Estate Market In Slovenia

Ppt Mortgage Policy And Real Estate Market In Slovenia

Fnb Life Assurance Has An Interesting Product Life Insurance Info

Fnb Life Assurance Has An Interesting Product Life Insurance Info

Individual Life Insurance And Investment Pioneer Your Insurance

Individual Life Insurance And Investment Pioneer Your Insurance

Comments

Post a Comment