Life insurance rates are regulated by law in your state. Depending on the contract other events such as terminal illness.

Life Insurance Application Form California Free Download

Life Insurance Application Form California Free Download

We created this network to people get the benefits they deserve even after their life insurance claims were denied or delayed.

Is life insurance required by law. Take a moment to read this article to see how premiums are regulated for your protection. Life insurance is defined as a mutual agreement by which one party agrees to pay a given sum upon the happening of a particular event contingent upon the duration of human life in consideration of the payment of a smaller sum immediately or in periodical payments by the other party. Life insurance is not required nor required by law.

Some people who have children feel that if they pass away then they want their kids to have some money and their spouse to have money for their burial. No life insurance is not required by law. Within each life insurance contract certain provisions may vary from policy to policy and company to company but there are certain provisions which are required by law to be in every life insurance policythese provisions enforce the foundation that life insurance was built upon.

Life insurance unlike health insurance is not required by law. There are scenarios where life insurance can be required such as a loan institution requiring you to carry a life insurance policy large enough to cover the debt in case of death. Life insurance laws state by state.

Those who are required to do so but do not are req. But there is no federal or state requirement that people buy life insurance at this time. Sometimes a court will order that life insurance be purchased as part of a divorce settlement and some lenders require the purchase of life insurance as collateral for a loan.

Life insurance law llc is a nationwide network of attorneys who work with clients to recover denied or delayed life insurance claims. Under current federal law in the united states all persons whose income exceeds the applicable poverty level where they reside are required to have in place an adequate health insurance policy. Much of the regulation of life insurance carriers happens on the federal level however most states also have regulations that affect policyholders.

Lists the major laws governing life insurance in every state explains how these regulations affect you the policyholder. Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder.

Present Law And Issues Relating To The Conservatorship Of The

Present Law And Issues Relating To The Conservatorship Of The

Search Q Elements Of A Contract Tbm Isch

Family Law Life Insurance Symbol Png Clipart Full Size Clipart

Family Law Life Insurance Symbol Png Clipart Full Size Clipart

Supreme Court Tax On Non Life Insurance Still Effective Svbb

Supreme Court Tax On Non Life Insurance Still Effective Svbb

Life Insurance Law Lifinsurancelaw Twitter

Life Insurance Law Lifinsurancelaw Twitter

Insurance Questions Archives Henson Fuerst Personal Injury Lawyers

Insurance Questions Archives Henson Fuerst Personal Injury Lawyers

Life Insurance Law Definition Life Insurance Lawyer

Life Insurance Law Definition Life Insurance Lawyer

Buy The Law Of Fire And Life Insurance With Practical

Buy The Law Of Fire And Life Insurance With Practical

Life Insurance For Police Officers Law Enforcement Personnel

Life Insurance For Police Officers Law Enforcement Personnel

Law And The Life Insurance Contract The Irwin Series In Financial

Law And The Life Insurance Contract The Irwin Series In Financial

What Should I Do With All These Life Insurance Policies Inquiring

What Should I Do With All These Life Insurance Policies Inquiring

Sc Upholds Bir Move To Impose Higher Taxes On Non Life Insurance

Sc Upholds Bir Move To Impose Higher Taxes On Non Life Insurance

Practising Law Institute Payment Mail Life Insurance India Post

Practising Law Institute Payment Mail Life Insurance India Post

Peter Pan On Twitter Plhiv Must Not Be Denied Of Life Insurance

Peter Pan On Twitter Plhiv Must Not Be Denied Of Life Insurance

Life Insurance Lawyers In Chicago Il Gainsberg Law

Life Insurance Lawyers In Chicago Il Gainsberg Law

The Law Of Life And Health Insurance Lexisnexis Store

The Law Of Life And Health Insurance Lexisnexis Store

Life Insurance As A Tool For Adv Estate Planning 6 Ce Credits

Life Insurance As A Tool For Adv Estate Planning 6 Ce Credits

In Every Private Or Public Company And Even Non Profit

In Every Private Or Public Company And Even Non Profit

Get The Life Insurance Coverage You Need For Your Family S Safety

Get The Life Insurance Coverage You Need For Your Family S Safety

Do Insurers Accept Claims From Death By Suicide Haffner Law

Do Insurers Accept Claims From Death By Suicide Haffner Law

Life Insurance Companies Can Now Access Your Social Media Content

Life Insurance Companies Can Now Access Your Social Media Content

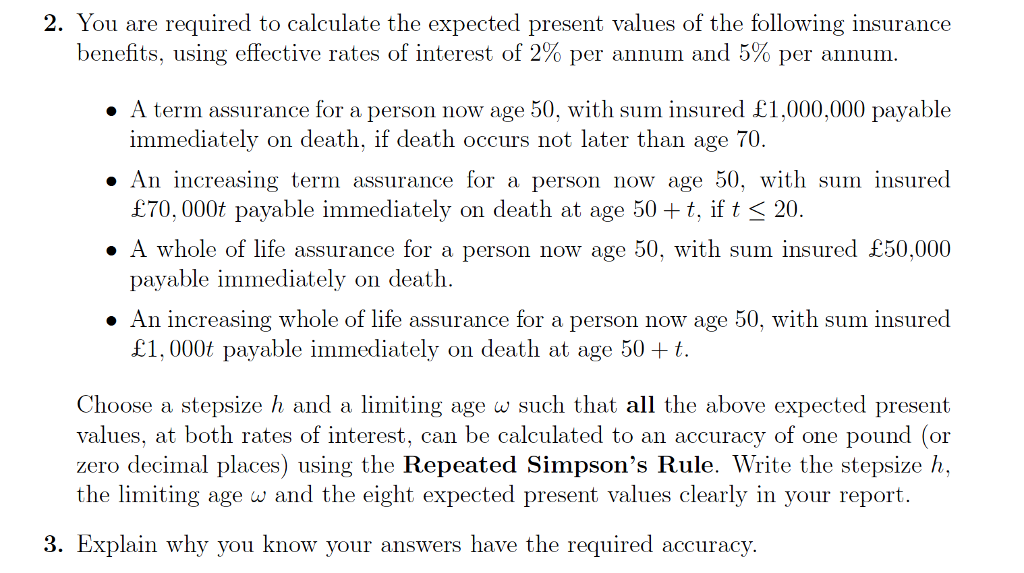

The Following Is In Relation To Life Insurance Mat Chegg Com

The Following Is In Relation To Life Insurance Mat Chegg Com

Comments

Post a Comment