Early payout for chronic or terminal illness. Our guide to life insurance tax outlines when tax is applicable to life insurance payouts.

Insurance Policies Are Tax Free Thetaxtalk Not All Proceeds From

Insurance Policies Are Tax Free Thetaxtalk Not All Proceeds From

Called a life insurance surrender as long as your settlement amount is less than the total you paid in premiums your surrender payout is tax free.

Is life insurance tax free. Find out how to get tax free life insurance and compare quotes. Estate tax advantages of permanent life insurance. Life insurance protects your family from your financial debts and obligations after you die by providing a death benefit but it also may be used for business purposes to compensate a company for the loss of a key person in the company.

There are various types of life insurance but term insurance is the most common and the most straightforward. Life insurance proceeds may be tax free depending on what proceeds you or your beneficiaries receive. First life insurance premiums whether paid personally or by a corporation are typically non deductible resulting in premiums being funded with after tax dollars.

One of the benefits of owning life insurance is the ability to generate a large sum of money payable to your heirs upon your death. Term life insurance or permanent life may both be used for this purpose because the focus is the death benefit payable to the heirs. On the other hand life insurance death benefits are tax free.

Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout. Life insurance is often used to provide liquidity to pay federal estate taxes. Permanent insurance which provides lifetime coverage as long as premiums are paid initially has higher premiums.

Types of life insurance policy. An even greater advantage is the federal income tax free benefit. Life insurance proceeds arent taxable most of the time your beneficiaries wont have to pay a tax unless the proceeds become part of your estate and your estate is large enough to be taxable.

Many permanent life insurance policies offer riders or add ons that cover unexpected chronic or terminal illness. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it. Tax is a tricky subject so if you have a non qualifying policy or if you are unsure about setting up a trust you should talk to a specialist adviser.

This tax free exclusion also.

Life Insurance Policies Income Tax On Life Insurance Policies

Life Insurance Policies Income Tax On Life Insurance Policies

Guide To Are Whole Life Policies Tax Free Life Insurance Canada

Guide To Are Whole Life Policies Tax Free Life Insurance Canada

Selling Tax Free Retirement Is Easy When You Remember These Six Tips

Selling Tax Free Retirement Is Easy When You Remember These Six Tips

Use Life Insurance For A Tax Free Estate Plan Investing 101 Us

Use Life Insurance For A Tax Free Estate Plan Investing 101 Us

Tax Benefits On Life Insurance Linksking

Tax Benefits On Life Insurance Linksking

The Tax Advantages Of Life Insurance Youtube

The Tax Advantages Of Life Insurance Youtube

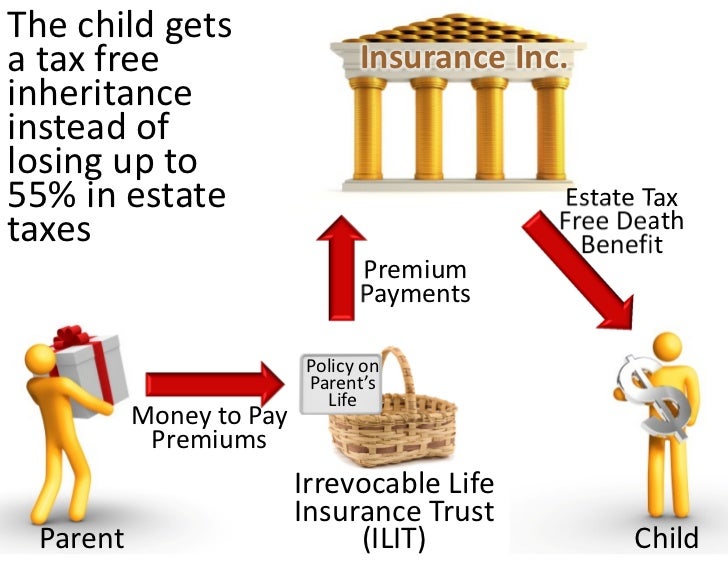

Tax Free Life Insurance Or 55 Tax What You Need To Know

Tax Free Life Insurance Or 55 Tax What You Need To Know

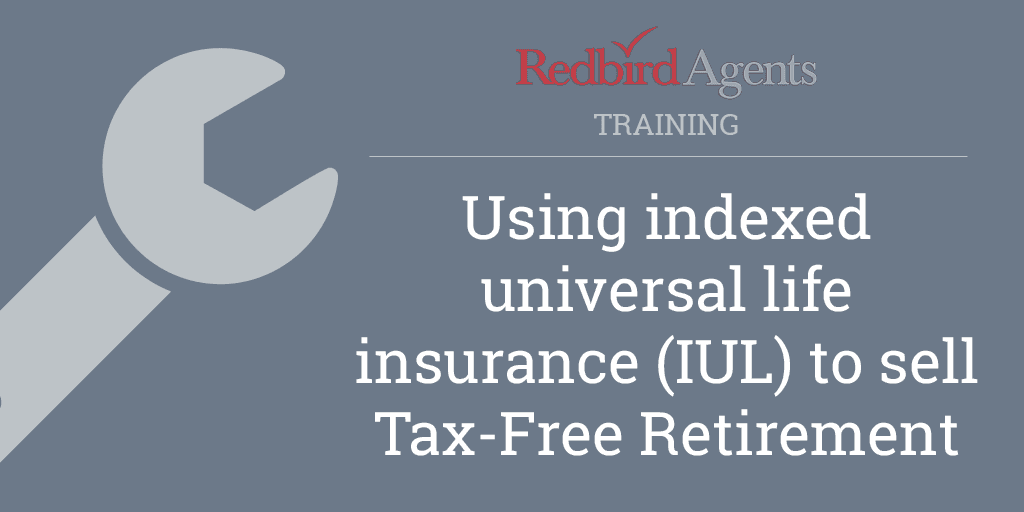

Who Gets Life Insurance Payout Make Sure Your Beneficiary Gets Paid

Who Gets Life Insurance Payout Make Sure Your Beneficiary Gets Paid

Life Insurance And Taxes Managing Your Policies Stay At Home

Life Insurance And Taxes Managing Your Policies Stay At Home

Is Life Insurance Taxable The Tax Advantages To Owning Life

Is Life Insurance Taxable The Tax Advantages To Owning Life

Things You Should Know About Your Whole Life Insurance Benefits

Things You Should Know About Your Whole Life Insurance Benefits

Money Wealth Life Insurance How The Wealthy Use Life Insurance

Money Wealth Life Insurance How The Wealthy Use Life Insurance

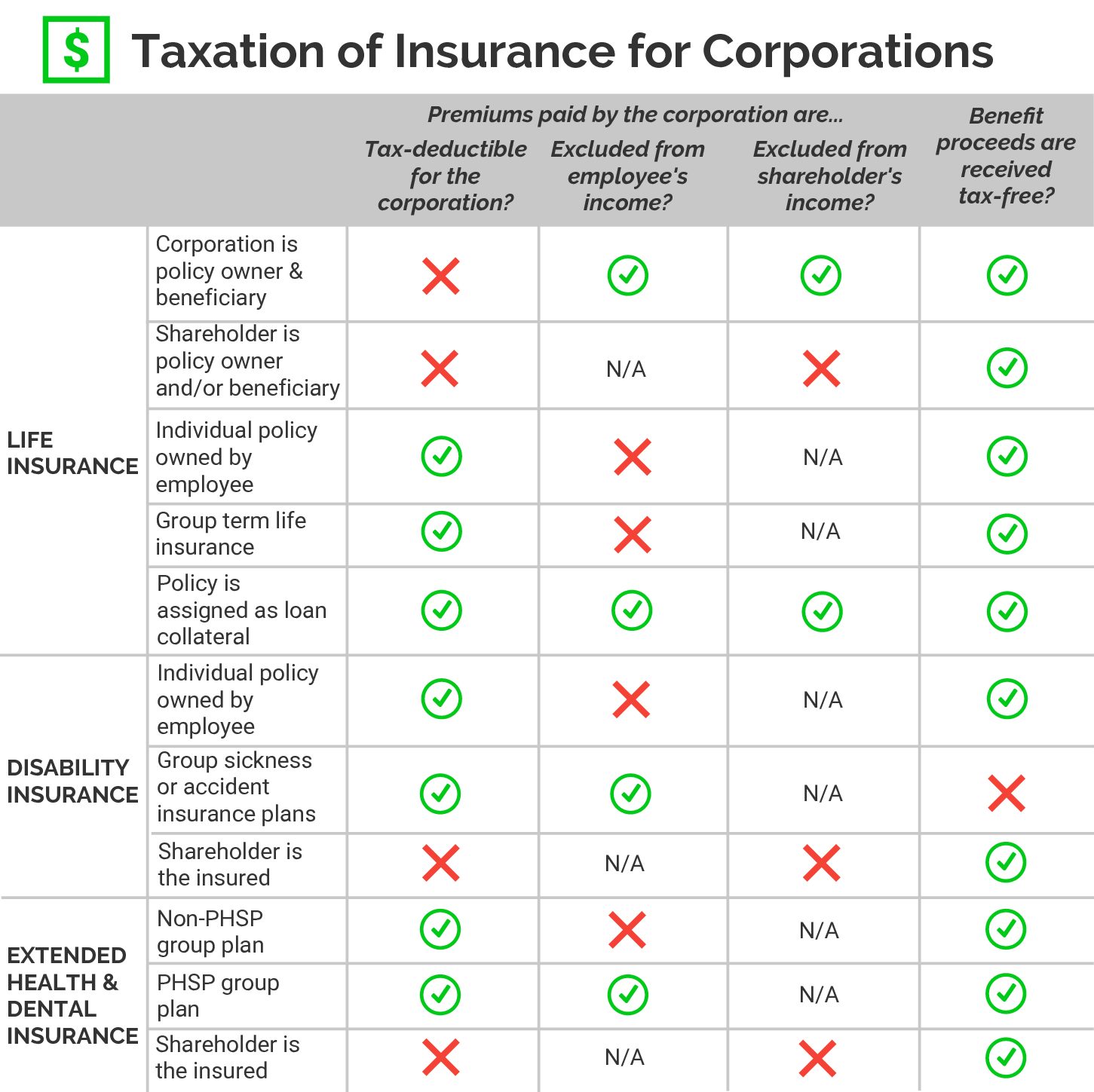

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

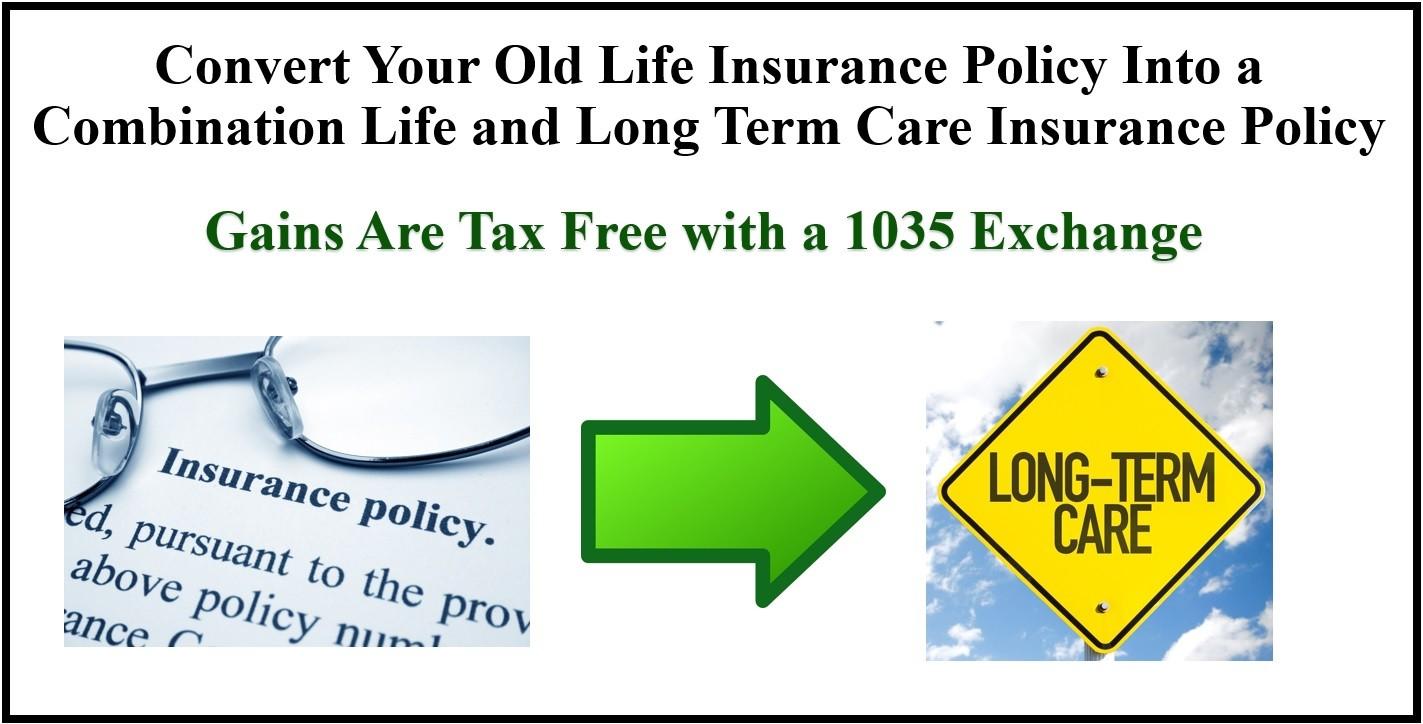

1035 Tax Free Exchange Convert Your Old Life Insurance Policy

1035 Tax Free Exchange Convert Your Old Life Insurance Policy

Is Maturity Benefit In Life Insurance Tax Free Comparepolicy

Is Maturity Benefit In Life Insurance Tax Free Comparepolicy

Life Insurance Charitable Remainder Trusts

Life Insurance Charitable Remainder Trusts

The Income Miracle How To Use Life Insurance For A Safe And Tax Free

The Income Miracle How To Use Life Insurance For A Safe And Tax Free

Life Insurance In A Changing Tax Environment M Financial

Life Insurance In A Changing Tax Environment M Financial

Free The Income Miracle How To Use Life Insurance For A Safe And

What Is A Tax Free Death Benefit For Life Insurance Studio Val

What Is A Tax Free Death Benefit For Life Insurance Studio Val

Comments

Post a Comment