Group life insurance can be a nice addition to your benefits package especially if its free or nearly free. But most large sums of money like lottery winnings are subject to tax.

See topic 403 for more information about interest.

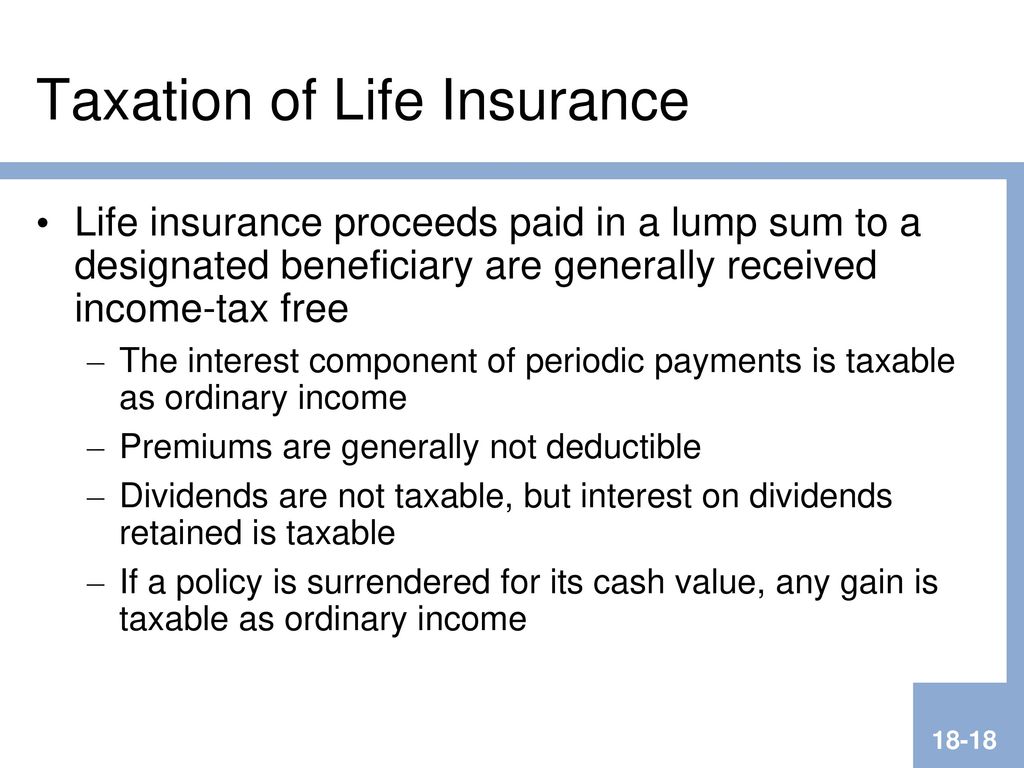

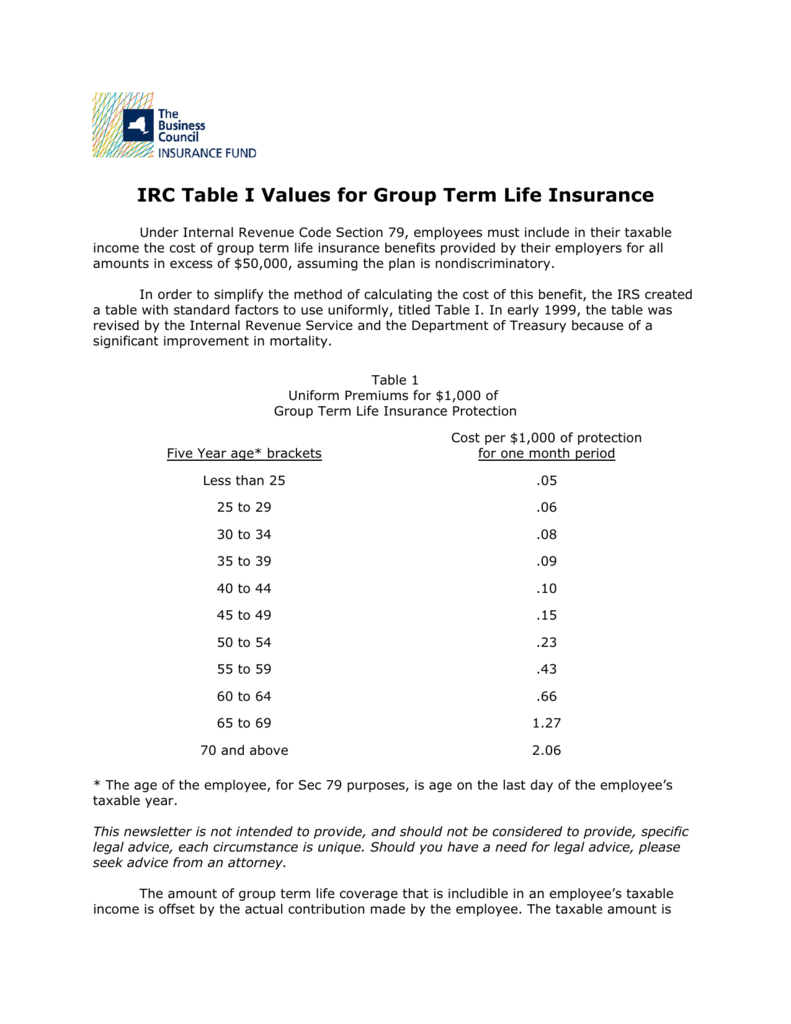

Is life insurance taxable. Our guide to life insurance tax outlines when tax is applicable to life insurance payouts. Usually not but some scenarios do allow for the death benefit to be taxed. If you have employer provided life insurance known as group life insurance any coverage over 50000 is treated as taxable income but any amount under 50000 is not taxed.

Life insurance can give your loved ones financial security should you die. But there are some exceptions. We want to put your mind at ease first by highlighting some specific instances where you dont have to worry about taxes on life insurance.

Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout. In most cases life insurance proceeds are not taxable so your beneficiaries should get the full amount available under. Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them life insurance.

But here are situations where life insurance proceeds could be taxable. Life insurance payouts are made tax free to beneficiaries. The irs spells it out.

Well talk more about when you do have to pay later. Heres how it works. Life insurance is one of the best ways to build a financial safety net.

It provides money to beneficiaries to pay for things like college a mortgage and more. Life insurance is almost always not taxable. The life insurance money you receive as a beneficiary when an insured person dies is generally not taxable.

Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. You do not have to report the money as income to the irs. Most of the time life insurance is not taxable.

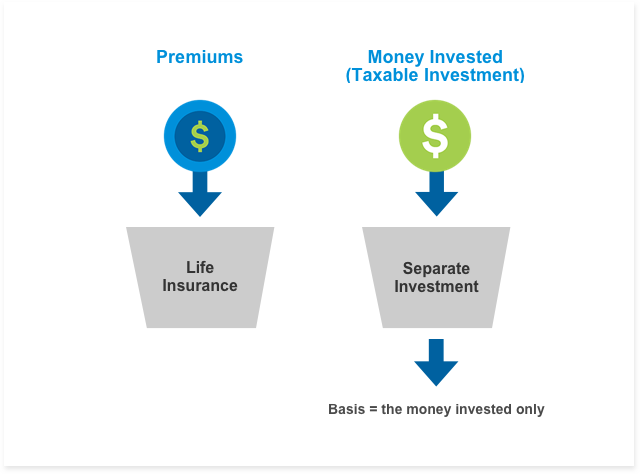

However any interest you receive is taxable and you should report it as interest received. But there are times when money from a policy is taxable especially if youre accessing cash value in your own policy. Therefore its not taxable.

Find out how to get tax free life insurance and compare quotes. This tax free exclusion also. A life insurance payout isnt considered gross income.

So are life insurance proceeds taxable.

Chapter 13 18 Life Insurance Purchase Decisions Ppt Download

Chapter 13 18 Life Insurance Purchase Decisions Ppt Download

Are Life Insurance Death Benefits Taxable Income Finance Zacks

Are Life Insurance Death Benefits Taxable Income Finance Zacks

Life Insurance Policy Payouts Are They Taxable Or Not Income

Life Insurance Policy Payouts Are They Taxable Or Not Income

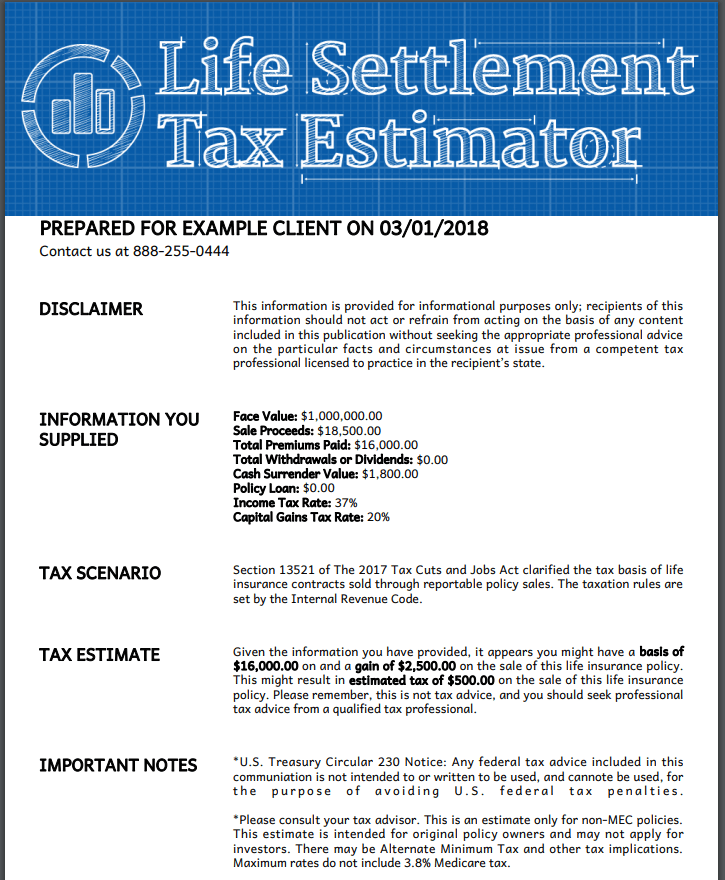

How Is The Sale Of A Life Insurance Policy Taxed Life

How Is The Sale Of A Life Insurance Policy Taxed Life

Are Life Insurance Payouts Taxable Life Ant

Are Life Insurance Payouts Taxable Life Ant

Life Insurance And Taxation Youtube

Life Insurance And Taxation Youtube

Is A Life Insurance Payout Considered Taxable Income My Senior

Is A Life Insurance Payout Considered Taxable Income My Senior

Is Life Insurance Taxable Tampa Florida Mintco Financial

Is Life Insurance Taxable Tampa Florida Mintco Financial

To Have Access To Irc Table I Values For Group Term Life Insurance

To Have Access To Irc Table I Values For Group Term Life Insurance

Are Life Insurance Premiums Paid By Employer Taxable

Are Life Insurance Premiums Paid By Employer Taxable

Is Life Insurance Payout Taxable In Canada Stingypig Ca

Is Life Insurance Payout Taxable In Canada Stingypig Ca

When Are Life Insurance Benefits Taxed Texas Republic Life

When Are Life Insurance Benefits Taxed Texas Republic Life

Life Insurance Overview Group Variable Universal Life Metlife

Life Insurance Overview Group Variable Universal Life Metlife

Tax Reform How Your Increase In Take Home Pay Can Be Invested

Tax Reform How Your Increase In Take Home Pay Can Be Invested

Income Tax On Maturity Amount Of Life Insurance Policy Simple

Income Tax On Maturity Amount Of Life Insurance Policy Simple

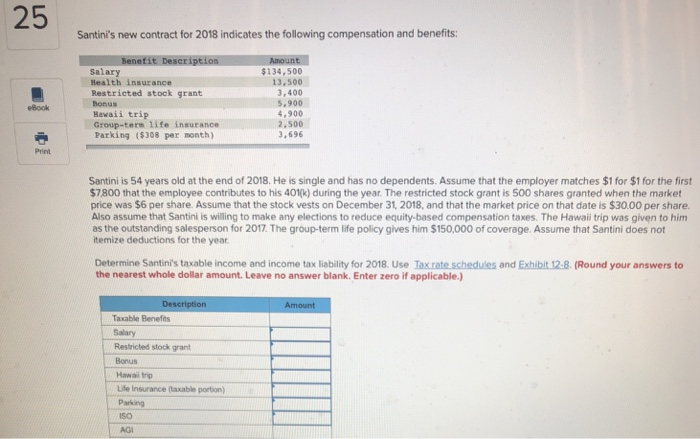

Solved 25 Santini S New Contract For 2018 Indicates The F

Solved 25 Santini S New Contract For 2018 Indicates The F

Quiz Worksheet Group Life Insurance Taxation Study Com

Quiz Worksheet Group Life Insurance Taxation Study Com

Life Insurance And Taxes Bestow

Life Insurance And Taxes Bestow

Is Life Insurance Taxable True Blue Life Insurance

Is Life Insurance Taxable True Blue Life Insurance

Life Insurance Taxation George Curtis 9781376042160 Amazon Com

Life Insurance Taxation George Curtis 9781376042160 Amazon Com

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

Comments

Post a Comment