In most cases life insurance proceeds are not taxable so your beneficiaries should get the full amount available. For example say you have a life insurance policy with a cash value of 400000.

Some policies allow you to borrow against the cash value of your life insurance instead of a withdrawal.

Is money from life insurance taxable. In most cases if you withdraw money from an insurance policy that has a cash value then the cash value of the life insurance is taxable. If youre named as the beneficiary of a life insurance policy you may expect a substantial windfall upon the death of the policyholder. Instead of withdrawing money from your life insurance policy you might consider taking a loan against the cash value of your policy.

Taking out a loan against your life insurance policy does not count as taxable income according to the irs. Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away. Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout.

As with other loans the internal revenue service doesnt consider the amount of the loan to be taxable income when you withdraw it. But there are certain. But dont miss any payments or you may face taxes.

Life insurance can give your loved ones financial security should you die. Some permanent policies build up cash value that you can pull from while you are living. You paid 100000 in premiums but have a 300000 balance on an outstanding policy loan with no distributions.

Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it. This tax free exclusion also. Depending upon the size and structure of the payout this may feel like a sizable inheritance.

When you bought your permanent life policy you may have thought youd hold it until you died. Most of the time proceeds arent taxable. Are you taxed on inherited life insurance money.

Your life insurance money if tied up in a permanent policy can be taxable during your life. If circumstances change and you need cash more than you need a life insurance policy you can cash in the permanent life policy for the value from the premiums you paid and the interest and dividends you earned on the investments the insurance company made with your money.

Will My Beneficiaries Have To Pay Taxes On The Proceeds Of My Life

Will My Beneficiaries Have To Pay Taxes On The Proceeds Of My Life

1 Guide To Life Insurance Taxes Trusted Choice

1 Guide To Life Insurance Taxes Trusted Choice

Taxation Of Life Insurance Policy Loans And Dividends Repsource

Taxation Of Life Insurance Policy Loans And Dividends Repsource

Stock Redemption Agreement Archives John A Sanchez Company

Stock Redemption Agreement Archives John A Sanchez Company

Taxable Amount On A Surrendered Life Insurance Policy Budgeting

Taxable Amount On A Surrendered Life Insurance Policy Budgeting

Is Life Insurance Taxable Visual Ly

Is Life Insurance Taxable Visual Ly

The Advantages Of Life Insurance Proceeds Taxable Exovita

The Advantages Of Life Insurance Proceeds Taxable Exovita

Difference Between Cash Value And Face Value In Life Insurance

Difference Between Cash Value And Face Value In Life Insurance

Life Insurance Policies Are Life Insurance Policies Taxed

Life Insurance Policies Are Life Insurance Policies Taxed

Introduction To Income Taxation Gross Income General Rule

Introduction To Income Taxation Gross Income General Rule

Life Insurance Taxation 2018 01 Online Banking Clicksaltlake Info

Life Insurance Taxation 2018 01 Online Banking Clicksaltlake Info

Is Life Insurance Taxable Guide To Understanding Life Insurance

Is Life Insurance Taxable Guide To Understanding Life Insurance

Pension Policies By Life Insurance Cos Are Taxable

Pension Policies By Life Insurance Cos Are Taxable

Avoid Surrendering Life Insurance Policy 1

Avoid Surrendering Life Insurance Policy 1

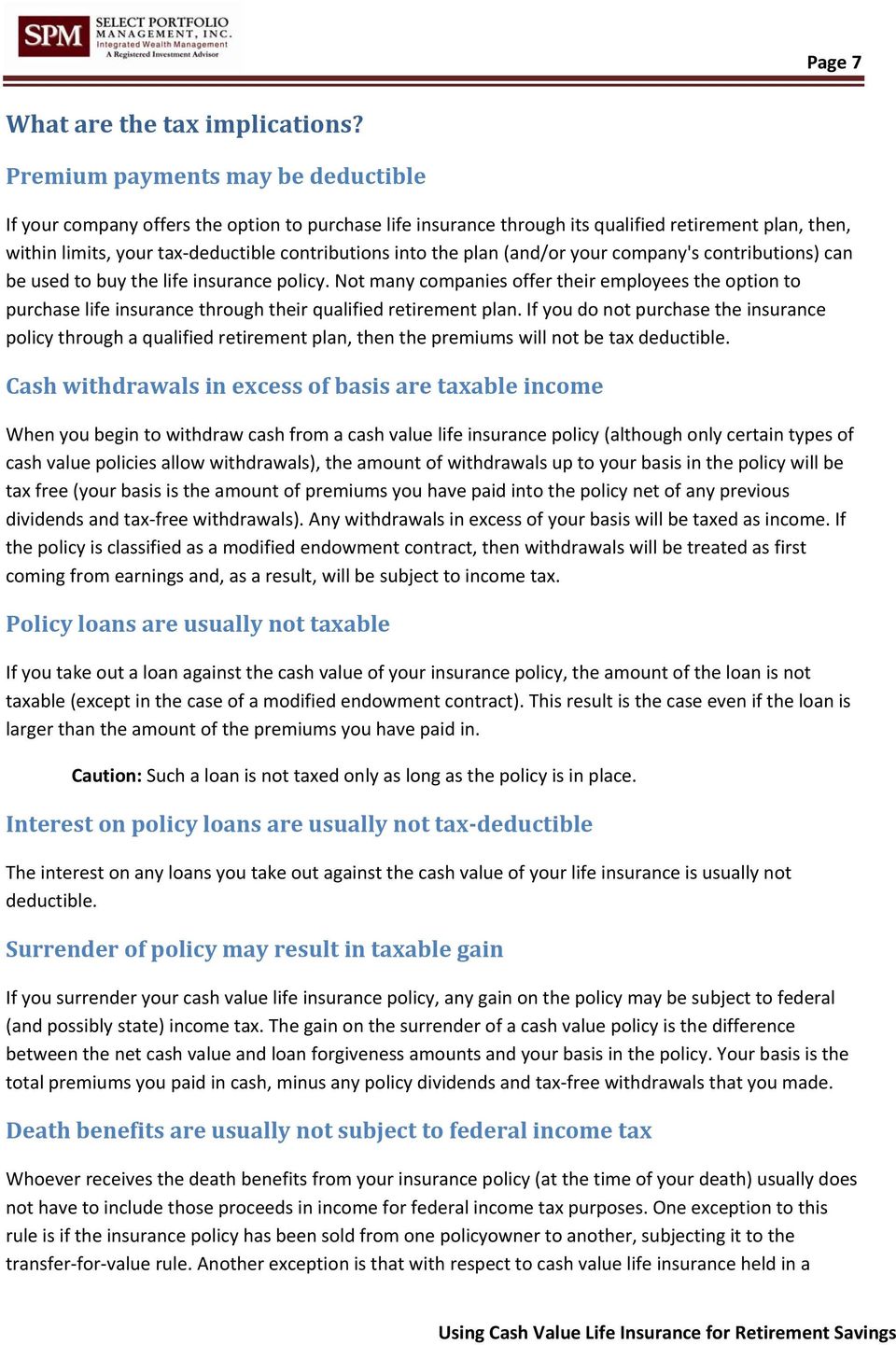

White Paper Using Cash Value Life Insurance For Retirement

White Paper Using Cash Value Life Insurance For Retirement

Life Insurance Policy Payouts Are They Taxable Or Not Income

Life Insurance Policy Payouts Are They Taxable Or Not Income

Are Life Insurance Annuities Taxable

Are Life Insurance Annuities Taxable

Are Life Insurance Premiums Tax Deductible Quotacy

Are Life Insurance Premiums Tax Deductible Quotacy

Can I Cash In A Whole Life Insurance Policy Farm Bureau

Can I Cash In A Whole Life Insurance Policy Farm Bureau

Ppt Group Insurance Life And Disability Benefits Powerpoint

Ppt Group Insurance Life And Disability Benefits Powerpoint

Taxes On Life Insurance Here S When Proceeds Are Taxable

Taxes On Life Insurance Here S When Proceeds Are Taxable

Benefits Of Irrevocable Life Insurance Trust The Law Offices Of

Benefits Of Irrevocable Life Insurance Trust The Law Offices Of

Comments

Post a Comment